Context Collapse, Context Capital, and Capital Thoughts

Sajith Pai's regularly irregular newsletter #32

Welcome to the 32nd edition of my irregular newsletter. Since the last newsletter, published just in late December (you will see the reasons for the delay below!), we saw 1,200+ new subscribers sign up for the newsletter. Welcome aboard my new subscribers, and enjoy your first newsletter.

Quick housekeeping announcements for the new subscribers. The newsletter has two permanent sections: Writings - where I usually write and / or refer to one or more original pieces that I published in the previous months, typically about venture or the startup ecosystem, and Readings - about what I read and learnt about. My reading diet is tilted rather heavily in favour of books and podcast transcripts, and against articles / newsletters. This will naturally reflect in the reading list.

This is a long newsletter - think of it as akin to a monthly magazine from me (only the frequency may not be monthly!). I don’t know if you can read this entire newsletter (and peruse the links) in one sitting, and even if you do a second run ( which I very much doubt), you will have to pick and choose what to focus on. A good way to read this newsletter is to certainly read my original writing(s) below, and then glance through the rest and pick 1-2-3 items that pique your interest. Anything more is a bonus!

Writings

1/ Context Collapse

The last issue of this Substack was published in late December. The 3 month gap is largely due to the fact that I (along with my colleagues) was busy with prep work for the 2025 edition of the Indus Valley report, which released late February. There is a fair amount of heavy lifting that happens in the first two months of the year, concentrated in the mid-January to mid-to-late February period, and that means that there isn’t much time for reading or writing stuff outside the scope of the report.

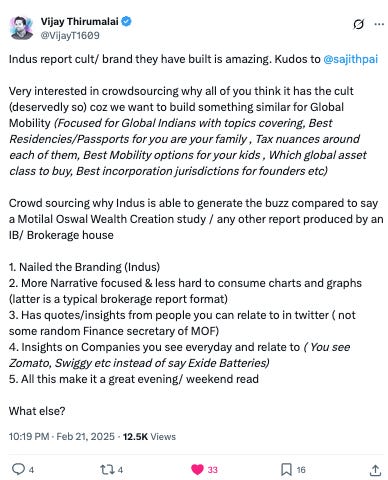

The Indus Valley report has become a much loved and celebrated fixture for the Indian startup ecosystem. Like last year and maybe even the year before, it was accompanied by memes, twitter threads, summaries, and increasingly videos remarking on the takeaways from the report, or just well commenting on the report.

Some of my fave tweets. Not all the tweets below are rah-rah as you will see.

Source: Twitter / X

Source: Twitter / X

Source: Twitter / X

Source: Twitter / X

Source: Twitter / X

Source: Twitter / X

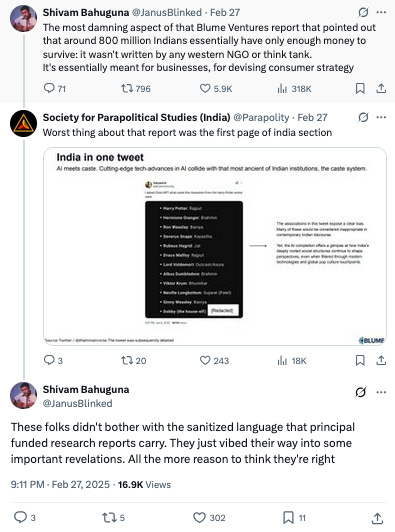

As the last two tweets show, not everyone who tweets about the report is praising it. Some find it too simplistic, and some are puzzled by why a 188-page report with 250+ charts gets so much traffic and reaction on the interwebs, positive or otherwise.

Here I must confess that when we created the report in 2022, to serve as an Indian equivalent of the famed (and now discontinued) Mary Meeker report, I did not anticipate the sheer popularity of the Indus Valley Report, and the varied reactions to each annual issue. We created the report half as a marketing document to sell India and Blume to potential investors (Limited Partners), and half as a chronicle of the exciting Indian startup ecosystem for industry observers. The structure of the report (India and Indus Valley) reflects the dual purpose of the report.

Over the past four years, I have been struck by how much the intended audience has given way to an actual audience of Indus Valley citizens, significantly in Bangalore, largely male, and predominantly in the startup world, using the report to derive trends, ideas, patterns and use AI to parse the report and share their findings with the world on social media.

This year, the report jumped outside the tech bubble and found its way into policy circles, and political discussions. A BBC story with a provocative headline was likely the superspreader event (or spur?) leading to the report moving out of tech circles into the mainstream. Naturally BBC’s story sparked copycat articles in many mainstream publications, and soon, the report got picked by the Indian National Congress party, resulting in tweets from Congress party leaders Jairam Ramesh, Mallikarjun Kharge, Priyanka Gandhi Vadra etc. For the next few days my colleagues and I were a bit tense about the issue spiralling into a political circus. We hadn’t written the report as a critique of any party and we didn’t want the report to become political football. We consulted an ex-Minister, as well a crisis consultant, and even readied a press release in case the issue spiralled. Thankfully the issue died down, but the last two days of February were fairly tense days for me and a few of us at Blume.

What I found interesting was that none of this was picked up in the tech community - by now the Tech community was done with the report and they had moved on to other stuff, at least on twitter [Linkedin picked up the report a week after this:)]. In fact, even most of my colleagues didn't pick this up, for none of them follow any political leaders, and are quite apolitical. Those two days were quite surreal.

Around the time, this was raging, my colleague got a message on Whatsapp saying the report had gone ‘too viral’.

I found the comment amusing in that you can’t control or calibrate virality once it starts spreading. You can’t say “let me make it 66% or just enough viral”. There is no way to tamp down virality, though you can stoke it more if needed a bit through commentary (social boosts) and marketing spends.

The virality of the report post the BBC story, its coverage in mainstream media, and subsequent use in political commentary, is an example of what is termed as context collapse, defined as “where content intended for one audience can reach others, resulting in misinterpretation or negative reactions due to a lack of understanding of the original context” (Perplexity). The tone of writing, the charts, the candour were all designed to be helpful to Indus Valley / founders, but once it went outside this context / universe, it was seen as criticism or casual commentary.

Source: Twitter / X

It is what happens on twitter when a tweet meant for a smaller circle goes viral and reaches folks who are unfamiliar with the issue or nuance. Once this happens, then it is best to delete the tweet. But in our case we couldn’t delete a report, could we?

From context collapse to context capital.

2/ Context Capital

I thought the following passage from Victor Lazarte, Benchmark’s newest partner (on the Venture Unlocked podcast) was fascinating.

“So you're not going to come in and like, just have this crazy insight. So the way we add value is, like, every week you're doing, frankly, like, part of it is this boring work that other people could do. Like you're closing candidates, having conversations with this candidate, explaining to them, why the vision is amazing, why the entrepreneur is great. And you're doing all this work that, frankly, a lot of people could do.

But through that, you're getting a lot of context on the company. And then two or three times a year, the entrepreneur is going to make a very important decision, and he will need a thought partner.

The entrepreneur has two choices. Like, if either they're going to call you and discuss what's going on, or you'll have to call someone else and spend like a couple of hours explaining the context that the person needs to be able to help make the decision.”

And he's going to call you because you're the only one that has context, like you're the only outside person that has context on the company. So in a way, all this work that you do, week in, week out, is kind of like a tax that you pay for when the really important decision comes along”

“You're in this position that, hey, you're able to help the entrepreneur. You're able to be the thought partner that this entrepreneur needs when making that decision. And this compounds very strongly over time. It's like this two or three times a year, you make that decision marginally better.

Like over the 10-year journey that it takes to build a company, like your company is going to be a lot better, right? And your relationship with the entrepreneur will also compound in this way. It's like five years in.”

Victor’s assertion that VCs provide ready context to founders when they work with them closely over a long period, is an interesting parallel to context windows in querying LLMs (that is, the amount of text it can consider and process to arrive at an output). You can think of venture capitalists as providing long, preloaded, (almost) available context windows to their founders through their long interactions with the founder and the company. Reading this passage brought back memories of a past conversation.

A few months back I had to recuse myself from supporting company X due to a conflict with company Y. Company X and Y were both companies I had been supporting from the beginning, but I was more closely associated with company Y. Company Y was exploring something in X’s domain and that was the spur. When I reached out to the founder of Company X, to tell him I have to recuse myself from his co, he was a tad upset and said “I have shared so much with you, and all of Company X is in your head”. At that point I told him will never share anything outside with Company Y and he said but that is not the worry. I was puzzled when we terminated the convo. Now I have understood what he was trying to say. I was deleting all the carefully stored context we had preloaded as prompts in my brain, and was wiping the memory clean.

As seed / early stage investors, this is a real and rare privilege we have - that of holding this context in our heads so our founders can quickly check with us and get our thoughts / reactions. For other privileges read this piece on the seed investor as priest-jester. We need to continuously add to this context and hone it, and be effective stewards. Essentially, good venture is about providing sufficient context capital to our founders.

3/ Capital Thoughts

I recently completed 10 years in Delhi, India’s capital city. Well, strictly speaking, I have lived the last decade in Noida, a satellite city of Delhi, part of the Delhi National Capital Region (NCR), and tightly integrated with Delhi, and so this will do. Neither me, nor my wife, have roots or relations in Delhi or the wider region. So what am I doing here in Delhi?

Well, we moved here in 2015 (after 17 years in Bombay!) primarily for my work. This was to set up Bennett University (as part of The Times of India Group) which had received a license from the Uttar Pradesh government. The most optimal location for the university (keeping in mind variables such as cost of real estate, and proximity to Delhi) was Greater Noida, and thus distance from the university site as well as ready access to good schools for our daughters, meant Noida won over Delhi. So we found a house in one of the gated communities / apartment complexes along the expressway from Noida to Greater Noida and set up home. Coming from dense buzzy Bandra where we had lived much of our Mumbai life to the sprawl of Noida Expressway was a tad disorienting, not to mention the differences in culture, people etc. But we adjusted.

Subsequently after the university launched, following three years in Delhi, I shifted to Blume, but I continued to be based here in Noida / Delhi. Blume wanted to bulk up its presence here; at that time, we only had Arpit Agarwal here, and he was very happy to see the Delhi presence double. Subsequently we added more folks to the team, though gradually they have all left Delhi for Bangalore (including Arpit). I now find myself the sole investing member of the Blume team in Delhi:(

On this topic of relocations, I remember my parents shifting to Delhi in the mid-90s, my dad receiving his mandatory North India posting (he was working in a South Indian bank). They had lived in the South all their life and the shift was initially traumatic for them, though they eventually learnt to adjust (my mum even taking to the Salwar Kameez) both learning toota-foota or broken Hindi, and even enjoyed their stint. But the first year was tough, both struggling with the language, the weather, the expenses etc. In comparison my shift was a breeze. I was shifting to a large well-managed and well-staffed gated community. Then there were all the usual apps - Uber, Urban Company, Google Maps - which made adjusting to the city, and accessing it a breeze. And being economically advantaged (vs my parents) made it easier to pay up, and access better restaurants or services, for if you are willing to pay up, then Delhi is kind to you.

A digression. I remember coming back from B-school to Delhi in the late ‘90s, and surviving on a small allowance from my parents and having to use the crowded bus service to travel around. [If I found it tough, then think of what the women had to endure.] The year after I got my first job, and my in hand income shot up, and life became easier, for I could now use autos (this was pre Uber, pre metro days) and afford slightly better restaurants. At the time I was living in Mumbai which is a far more affordable city than Delhi (outside of rents) and easier to get around thanks to trains. At that income level, Mumbai beat Delhi hands down on every front. But gradually with each passing year, my incomes rose, and when I was visiting Delhi, I was able to use taxis and cars to get around and even better restaurants, and buy at better shops, and slowly Delhi opened up to me.

The higher your income level and the better the places you spend time at in Delhi, the more superior the Delhi experience / package is in contrast with other cities - you meet better-looking people (sorry, Mumbai!), you have better and more interesting conversations (which is largely centred around Finance in Bombay and Tech in Bangalore while Delhi is more eclectic - literature, politics, policy, law, and also business / dhandha), and you have access to better experiences while shopping or being served. Of course I am stereotyping it. And this is my perception.

I remember the time I felt I could move to Delhi. This was 2013 or ‘14. I was working in The Times of India Group and our Delhi guesthouse was in Greater Kailash 1 (GK1) near the M-block market, and one day while walking around the place, seeing the bustling market, the people, the density, etc., I felt it wasn’t too far off the mark to Mumbai. There was now a large modern metro network, and the city seemed interesting as a place to work. I did worry about the perception that the city had of being unsafe for women, given that I would be moving with my wife and young daughters.

It is true that the confluence of office, residences, and retail, along with the high density of population, makes Mumbai far safer than any other city in India (Ahmedabad is another). Delhi in contrast suffers from zoning (office and residential areas are distinct), and low density, which means it is not walk-friendly (and also means it is less safe for women). Over time with restrictions on zoning easing somewhat (or being violated!) and rising density, it meant that there were parts of Delhi which are walkable to an extent. Vast swathes of South, West, and Central Delhi were seen as fairly safe for women, though perception still lingered.

Another digression. This time a story from my early settling in days. I was shifting from Bandra, a tony locality in Mumbai, to Noida. The gated community I was shifting to was part of a developing sector, and the nearest Canara Bank was in a small town adjoining the new sector. When I told the clerk I wanted to shift, she looked at my passbook (this was 2015, remember!) and said seriously “Aap ko account Bandra se Bhangel karna hai?” Yes, Bhangel was the name of the town! I promised myself that if I ever write an autobiography, then ‘Bandra se Bhangel’ would be the name of the chapter covering my Delhi shift and transition!

The 2015 to 2018 years were likely the best years for us in Delhi. I was in Times where my schedule was freer, and the kids were also young. We explored Delhi thoroughly during this phase. In 2018, I joined Blume and life steadily got busier. The elder one got into high school, and that meant with tuitions and exam stress, gradually her schedule also made it difficult to take out time for impromptu trips. Then came COVID, and our Delhi explorations came to a hard stop. Since then I have had a strange kind of existence in Delhi, tantalisingly close to all the interesting events and places, but lack of time, and the difficulty of making all of our schedules work, and then the occasional seasons of COVID shutdowns and pollution making local travel and exploration tough.

PostCOVID, our Delhi office presence also gradually whittled down as colleagues moved on. We recruited three young women to be based in Delhi (one of whom was originally from Delhi), and all three shifted to our Bangalore office, the first chance they got. Specifically in venture / startupland, Bangalore is where the action is and I am not surprised at all. It is also the case that both in perception and very likely in reality, Bangalore is safer for women than Delhi. I have the privilege of being male and being able to sleep in an uber going back home at 10pm in Delhi. No woman can. She will be on a call or have the phone ready to make a call to someone - her mother, her sister, her boyfriend etc. I don’t know if the same holds true in Bangalore - less so is what I have heard.

Over the past few years, as Bangalore’s dominance increased in the startup ecosystem (more below), my travel to Bangalore steadily increased, and I find myself there at least 10 days a month (see below for why). Increasingly, due to travel, a crazy schedule, mostly virtual calls, and relocation of our office to Noida (previously in Delhi), I find myself travelling less and less within the city, and thus interacting less with Delhi / city. It is a pity, for there is so much the city has to offer, in terms of talks, shows, events, but it is hard for me to partake of the feast given my context. I feel sad in a way, but well, that is life!

Over the last six and a half years in venture investing in Delhi, I have seen two clear trends.

The gap with Bangalore for non-consumer / non-marketplace has widened. This is even more true when it comes to top-tier teams. Increasingly when operators from a Delhi / NCR based co want to start up, more of them shift to Bangalore and start up. This is especially true if you are younger and / or don't have kids or dependent parents. For consumer brands (D2C brands) and marketplaces, I haven’t seen a significant shift, and Delhi’s share has held and is strong.

There has been a significant exodus of Delhi VCs to Bangalore. This has accelerated in the last couple of years. This is true of Mumbai too. In Delhi / NCR’s case it is led by the fact that the top-tier founder gap with Bangalore has widened, and the fact that pollution has been a challenge over the past few years. The extreme weather in Delhi NCR does not help, and the comparative good weather in Bangalore is a draw. Many VCs with young kids, and without any roots in Delhi have made the shift to Bangalore.

So why am I holding on? Well, we will shift too, to Bangalore, once we become empty-nesters. We nearly made the shift in 2020 during COVID, but we finally decided not to because of the disruption that shifting schools would cause to the kids’ lives and friendships. Now that the younger daughter is entering Class XII, we will probably look to shift next year once she leaves for her university. It will be 11 years in Delhi then. While I love Delhi, and will continue to, I don't think I will miss Delhi. It is perhaps time to move on, though the shift is a year away at least.

Living and working in Delhi, and interacting with Delhi founders, and Delhi in general does steel you up a bit. You are a lot pushier; and mentally you have to be a bit more on guard here. There are lots of microaggressions / micronegotiations - sometimes with your cab driver, sometimes with the parking guy, or the security guy, etc. This post by Rohit Krishnan terming it as bilateral negotiations captures it well. He describes life in India but what he says is especially true of Delhi. But over time handling these microaggressions becomes natural. You never show weakness or softness ideally:) My colleague Arpit once mentioned that after two-three years in Bangalore, on his travels to Delhi he was much more discomfited by these microaggressions / micronegotiations than before. I do hope I never lose this comfort with discomfort:) Take me out of Delhi, but don't take the Delhi-ite out of me. Don’t make me too soft!

Readings

Books

I finished four books over the last three months, two of whose notes I am sharing below (The others, I am still digesting). There are two other books in the halfway or unfinished stage. The first is Karthik Muralidharan’s book ‘Accelerating India’s Development’. I hit pause on it, for after three months of continuous readings on macroeconomic issues, I felt I needed a break:) I will revisit it soon. The second is ‘The Gujaratis’ by Salil Tripathi. I am enjoying this, and taking it slow. It is my (somewhat inconsistent) bedtime read, just before I turn the lights off. I get through 3-4 chapters (they are small chapters) a week! Here are my notes on two of the four that got done.

Richer, Wiser, Happier by William Green

Enjoyable read taking a close look at the investing approaches of public market long-only investors such as Mohnish Pabrai, Joel Greenblatt, Howard Marks, Bill Miller, Nick & Zak of Nomad, Charlie Munger and a few lesser known (at least to me) ones such as Tom Gayner, Matthew McLennan, Laura Geritz, Joel Tillinghast etc.

Interesting how their philosophies converge around concentration, patience, truth-seeking etc. Much of this is well-known / found in writeups on other investors as well. Still what stood out to me is an approach for which I use the word subtraction (maybe a fancy word for focus!) - that is eschewing 'riskier' or 'fragile' investments to come up a shorter list of potential stocks that they track and enter when attractive.

Pulak's book also described Nalanda's investment approach as centred around Subtraction. They track 85 stocks (somehow stayed in my mind) which have passed all their filters, and track them for markets like this when the price becomes attractive enough to load up.

Link to my highlights / excerpts from the book, organised by various investor and investment characteristics.

Unreasonable Hospitality by Will Guidara

Enjoyable breezy read covering the inner workings of running an elite restaurant in New York City, its evolution and rise to top-tier status from its previously middling rank, through a philosophy of giving equal status to service alongside food, and especially through elevating service to outrageous over the top levels through an approach the author terms as ‘unreasonable hospitality’.

What stood out to me was the efforts that went into uplifting service standards at the hotel including their obsession with getting everything just right, such as continually adjusting the music and lighting at the restaurant, adjusting it to existing noise levels and sunlight levels respectively (pgs 120-27 capture this well).

Along the same lines, there is a fascinating depiction, possibly my fave part of the book, where they describe the efforts they went to get the food and service right, for the NYT critic’s visit, given the high stakes nature of the paper’s review. They designated one random table every night as the critics’ table and used that for the dress rehearsal. Every night. The effort paid off in lifting the service and cuisine levels resulting in four stars (which only five restaurants in NYC had received). Pgs 175-76 covering this critic’s table effort is a treat.

Link to my notes on the book.

Articles

1/ Making Markets in Time by Abraham Thomas

Link to article. Link to article excerpts I found interesting, as well as my review of the article.

Good read, especially to understand what is behind the rise of ginormous venture funds, or venture banks as they are called such as General Catalyst, Lightspeed, Sequoia, A16Z etc., and what drives their actions.

Abraham Thomas says

“It’s not enough to build a good business per se; you need to build a business that is fundable by downstream investors: in other words, that hits the (arbitrary, but consensus) milestones that downstream investors care about. In this framing, a VC’s core competence is knowing when a company is fundable, not just by themselves, but also by downstream investors. Consequently, 80% of the value-add offered by 80% of VCs is helping companies with downstream funding.

People poking fun at VCs for being consensus are missing the point. You need alignment on stages and on milestones in order to make the transitions work; and you need support from downstream investors to keep the journey going. Without it, the whole ecosystem comes crashing down, to nobody’s benefit.

In venture, contrarian / consensus and right/wrong are not orthogonal axes; being right in multi-stage venture is defined by follow-on rounds and markups — in other words, by becoming part of the consensus. Venture is the Keynesian beauty contest in its purest form.”

2/ Letter to a Young Investor #2: A Consumer Investing Masterclass, by Kirsten Green, Mario Gabriele

Link to article (paywalled). Link to article excerpts I found interesting.

Particularly useful reading if you are a consumertech / consumer brands investor. Kirsten Green is one of the foremost consumer investors out there (Dollar Shave Club, Faire, Oura etc). She says

“There are three frameworks I return to in order to pressure test this: The first is The Consumer Experience - Business Model Test: does the business model itself enhance the product experience, or is it just financial engineering? A great example is Spotify – its subscription model isn’t just about creating revenue predictability; it fundamentally improves the experience by removing ads and enabling offline listening. Compare that to many other subscription-based consumer companies, where the model is in place primarily to benefit the company, not the customer. Similarly, virality is only a durable advantage when it meaningfully strengthens the product. Venmo’s viral loop strengthened its product experience – the more friends that joined, the more useful it became – while some fintechs relied on acquisition incentives that didn’t actually make their product better. If the business model doesn’t make the experience better for the consumer, it’s a red flag.”

“You asked if I strive to ‘live in the future.’ I wouldn’t say that – I focus on understanding the present so clearly that the future becomes inevitable. The most significant changes don’t appear out of nowhere; they build on signals here today. I engage with what’s emerging in a way that’s deliberate rather than reactionary. I’m not constantly testing every new product, but I do immerse myself in new ideas that challenge assumptions or reveal something about where behavior is headed. It’s less about chasing novelty and more about seeing the throughlines that indicate lasting change.”

It is worth noting how similar the above quote (on understanding the present to see the future) is to Matt Cohler’s quote (cited in Ravi Gupta’s podcast above) as well as the one by Victor Lazarte in the Venture Unlocked podcast (see below).

3/ Venture Capital’s Space for Sheep by Trae Stephens

Link to article.

Trae Stephens, Founders Fund, says

“The average investor does not spend all day simply searching for the best new company; they spend all day searching for the best new company in socially approved technology “space.” Twenty years ago, that space was e-commerce, the “dot.com”-ing of brick-and-mortar stores. Fifteen years ago, “social-mobile-local.” Ten years ago, the “sharing economy.” Three years ago, gaming and crypto. Now, it’s artificial intelligence.”

How true. We see this with Quick Commerce right now in India too. The speed with which follow ons happened in Zepto a few months back and Slikk of late (multiple rounds in two months when nothing has fundamentally changed in the business), it is clear that QCom is now the place for ‘socially acceptable’ deployment of capital (a la AI in the west), solving a real (first-world) problem of capital deployment for certain growth investors.

4/ The Rise and Fall of the Hanseatic League by Agree Ahmed

Link to article.

This is such a well-researched portrait of a fascinating entity, the Hanseatic League (late 12th century to 15th century CE), when merchants and city states across the Baltic sea coast and Northern Europe came together for trade, and formed a coalition, to protect and advance its interests. It even acted like how a state acts, such as waging war to protect its interests, even though it was not one. The article is also a great minihistory of Northern Europe in the first half of the last millennium. Interestingly this was written by a founder (of Flowglad, a YC co). I wonder how he found the time!

5/ Innovation, Sea Snails, and the Blind Professor by Alex Telford

Link to article.

A good review of a very interesting book (Nature: An Economic History by Geerat Vermeij, who is a blind scientist) on seeing parallels between evolution and economics / innovation. I find it interesting to read about parallels / analogies between evolution and economics (such as Pulak Prasad’s book), and this article was particularly interesting in that light.

6/ Bollywood’s Fantasy of Control Is Failing Everyone by Takshi Mehta

Link to article.

Good wrap of how high ticket prices and hence reduced visits to theatres, for Hindi films, along with the high prices paid for movies by streaming sites in the COVID / postCOVID era has led to an industry where stars demand absurd prices, but movies struggle to recover their budgets.

7/ Meet the Man Who Can’t Stop Founding Budget Airlines by Roshan Fernandez

Link to article.

“In David Neeleman’s view, competing head-to-head with the industry giants is a losing game. Speaking at a Breeze flight-attendant training session in mid-February, Neeleman wrote two numbers on a whiteboard: 90% and 86%.

The first figure reflected the percentage of routes where Spirit overlaps with other airlines. “They are in bankruptcy,” he said. (Spirit exited chapter 11 bankruptcy protection this month).

The second was the percentage of nonstop routes where Breeze has no competition—a figure that has now ticked up to 87%. “You aren’t just doing what everybody else is doing,” he said in an interview.

The airline reported its first full quarter of operating profit at the end of 2024 and has been growing steadily, now serving 70 cities with more than 280 routes.”

8/ Tyler Cowen, The Man Who Wants to Know Everything by John Phipps

Link to article.

“Cowen calls himself “hyperlexic”. On a good day, he claims to read four or five books. Secretly, I timed him at 30 seconds per page reading a dense tract by Martin Luther. Later, I sat next to him while he went through an economics paper. He read it at the speed of someone checking that the pages were correctly ordered.”

9/ How to Build a Truly Useful AI Product by Chris Pedregal

Link to article. Link to article excerpts I found interesting.

Terrific article by Chris Pedregal, founder of Granola on how to build AI products. Very provocative intro –

“The traditional laws of startup physics — like solving the biggest pain points first or that supporting users gets cheaper at scale—don’t fully apply here. And if your intuitions were trained on regular startup physics, you’ll need to develop some new ones in AI.”

I don’t entirely agree with this but there is some truth that you shouldn’t rush to solve the biggest pain point now (if constantly-improving LLMs remove that pain point you spend a lot of time working on, well, that is a lot of effort gone) but instead focus on enhancing context (which improves the AI-generated output) and the experience (which is not necessarily AI). It is a bit like airlines (don't worry about the 747 or 320) but on what the customer can do with it to get their work done (reach their destination in comfort).

10/ The Prophet of Parking by M Nolan Gray

Link to article.

“Yet by the final accounting, (Prof Donald) Shoup has a strong claim on being the scholar who will have had the greatest impact on your day-to-day life, radically changing how we approach the unglamorous problem of how and where we park our cars—and, in turn, where we can live, how we move about, and the form our cities take.

Shoup exercised unparalleled message discipline. He published his first paper on the topic in 1978 and spent the next half-century writing on little else. Aware of the responsibility of his celebrity, Shoup studiously avoided taking a position on almost any other issue. When protesters and counter-protesters flooded UCLA’s campus in response to the Israel-Palestine conflict, I asked for his take. ‘I’m just wondering where they all parked,’ he replied.

Indeed, Shoup worked hard to make his ideas palatable across the political spectrum. Are you a conservative? People should pay for the services they consume. Are you a progressive? All this unnecessary driving can’t be good for the environment. Are you a libertarian? Clearly, the solution to scarcity is prices and markets. Are you a socialist? Let’s stop privatizing the public realm by turning it into a free parking lot. As a result, the typical shoupista gathering is an oasis of peaceful coexistence.”

Podcasts

1/ Chris Pedregal, founder + CEO at Granola on the Colossus’ Invest Like The Best podcast w Patrick O’Shaughnessy

Link to podcast. Link to podcast excerpts i found interesting.

Yes, the same Chris above, who wrote the terrific piece on how founders should think about building AI products. This podcast is in much the same vein though I found it somewhat less useful than his article!

What stood out to me from the podcast:

Granola users take v different notes (more like states of mind / people-observations) than old-school note takers who cover facts / data from the convo

How native AI users provide context (far more) than normie users. Interestingly, in his article he had written about how features enhancing context window (by being able to provide the LLM with more info) results in better AI-generated output and user satisfaction.

Why AI wrapper / app creators should focus on high frequency use cases where output quality matters – those are safe from cannibalisation by LLMs

How critical the decision to make Granola a mac app that listened to via the device (as opposed to a bot that joined the call) was, and how that has made the biggest difference

We are still at the clunky UI stage for AI apps. In the early days of cars, a stick was used for moving the vehicle which was not as easily controllable as a steering wheel. It was also less safe. AI’s steering wheel era is yet to emerge, he says.

2/ Sean Ellis, Growth Consultant, on the Lenny Podcast

Link to podcast. Link to podcast excerpts i found interesting.

Sean Ellis is a marketer turned growth head who now consults (also wrote a book called ‘Hacking Growth’) companies on their growth challenges. He devised the now termed ‘Sean Ellis test’ for figuring out if you have product market fit, though in my view it is best used to determine if you have product to problem fit (the first phase of product market fit). This is a good conversation covering a bunch of topics including how to use the Sean Ellis Test, how to iterate on the score (improve time to value, make sure you are targeting the right customers etc), the importance of activation / onboarding etc. There is lots of good stuff here, especially if you are an early stage founder.

3/ Alok Goyal and Ritesh Banglani of Stellaris Venture Partners on the Neon Podcast w Siddharth Ahluwalia

Link to podcast. Link to podcast excerpts I found interesting.

Stellaris is an early stage venture firm in India, and they just raised their third fund of $300m. They spoke to Siddharth Ahluwalia on the Neon podcast about how the firm operates including their focus on ensuring 90% coverage of investments done in the market, why it is important to avoid or minimise adverse selection in venture, their decision-making process (i liked the concept of a ‘no-objection no’ as opposed to a firm ‘no’), as well as their process around proactive portfolio construction etc. Good podcast for venture nerds.

4/ Zal Billimoria, Refactor, on Venture Unlocked w Samir Kaji

Link to podcast. Link to podcast excerpts i found interesting.

Zal is the first Parsi I have encountered in VC but he is in the U.S.! (Parents moved to US midwest fm India). Zal is a solo VC (no team!) who raises a $50m fund every 3 yrs investing in deeptech. Fun episode for venture nerds who like to mull over portfolio construction math in their free time.

What stood out was how A16Z, Zal’s previous employer, incentivised better behaviour to founders via fines for coming later to founder meetings, as well as tracked founder NPS for individual partners, how Zal manages a one-person firm, how he thinks about portfolio construction etc.

This one point by Zal stood out to me as a significant one –

“…feel free to take as many pitches, even if they’re not in your categories of interest. If you’re just getting started and you’re building out your network, you’re building your reputation, you’re building your reps with founders. There’s nothing better than you having more cycles with founders so that you can actually base your gut instinct for when you actually find those special people. Take those pitch meetings extremely seriously. Be prepared, but understand that obviously 98% of them are probably not going to be fits, but you are building your own worldview as to what types of founders you want to work with. Because if you’re only meeting one or two new companies a week, you’re doing yourself a disservice because you’re not building your own kind of mental capacity for what’s possible and when that special founder comes around.”

5/ Ravi Gupta, Sequoia (prev Instacart, KKR) on the Colossus’ Invest Like The Best podcast w Patrick O’Shaughnessy

Link to podcast. Link to podcast excerpts i found interesting.

Podcast episode spurred by ‘AI or Die’, an article which Ravi wrote that went viral. Interesting podcast that captures how a tier1 Silicon Valley investor thinks about AI, and gives glimpses into the prevalent zeitgeist.

Two interesting points made by Ravi –

A startup can today build distribution (with an AI product) much much faster than before, and it seems faster than an incumbent can innovate. It is the widest that gap has ever been.

Ravi:“ If something’s an AI-first product, you probably shouldn’t care that much about the margins of it because it’s going to get so much cheaper to deliver that. Whereas if something’s not an AI-first product, you care a lot about the margins because that is the durable future.”

Three quotes from the podcast, shared by Ravi, that stood out

Matt Cohler, Benchmark: “Our job is not to see the future, it’s to see the present very clearly.”

Coach K, Duke: “I am not a world-class predictor, but I am a world-class reactor.” And he was referring to it as when college basketball changed from people that stay for four years to people that play for one and then go to the NBA. He was “I couldn’t have predicted that that’s the way the rules would go. I didn’t know. But you know what? Once that was the game on the field, I played it extremely well.”

Ravi: “…the Collisons, I don’t remember who said this, but they said they listen with predatory curiosity”.

6/ Tomasz Tunguz, Theory Ventures, on Venture Unlocked

Link to podcast. Link to podcast excerpts i found interesting.

Some interesting quotes from the podcast -

“We are looking for applications of AI in two categories. The first is AI does work that a human cannot do. primarily because of scale. The other category we’re looking for AI is where there are shortages in the labor market. You have three things, toil, really unappealing work, nobody wants to do it.”

“Samir: What in your mind makes a company truly defensible in the world of creating an AI app?

Tomasz: I think it’s workflows. It’s not the technology. And this parallels to the previous wave of SaaS. There’s nothing technically different from Salesforce and an upstart CRM. There’s not. They’re all just databases with web pages on top. And within the world of AI, I think there’s an opportunity to reinvent those workflows because now all of a sudden the work has changed, right? A salesperson can manage many more leads. A marketing person can produce much more content. A lawyer can review many more contracts. And so the workflows themselves have changed. So the defensibility comes from identifying which of those workflows have changed and building the software.…there’s about one and a half trillion dollars worth of software and infrastructure spend today. And if you think about how much a company spends on software, it’s about 5% of revenues on average. AI offers an opportunity to go after labor spend in a pretty meaningful way. And labor spend might be 30 to 40% or more of this company. So if you can grab, I mean, you think about this, the market’s at least eight times as large going with AI.”

7/ Shruti Rajagopalan on Ideas of India

Link to podcast. Link to podcast excerpts I found interesting.

Shruti Rajagopalan who hosts the Ideas of India podcast, did an annual retrospective highlighting the podcasts they did in 2024, with her reflections on it. I like this format which was begun by her celebrated fellow Mercatus podcast host Tyler (link for his retro).

What I found interesting

Books that Shruti thinks are superuseful to unpack the Indian economy: Arvind Panagariya’s India: The Emerging Giant, Tirthankar Roy & Anand Swamy’s Law and the Economy in India: Before Independence and After, Vijay Kelkar & Ajay Shah’s In Service of the Republic, and Arun Shourie’s Governance

Too many young PhDs writing too many RCT (Randomised Controlled Trial) papers and not enough big picture macro / development explorations. This is led by the present incentive architecture of getting your paper into the big 5/10 journals, she says.

Under-researched topics in Economics today: Immigration / Migration within India (some of the internal state to state flows are bigger than many country flows she says), Trade, Air Pollution.

She is rethinking how much education alone can impact lifetime earnings (especially those coming from disadvantaged backgrounds). Family background matters a lot (Jim Heckman’s research has been an influence)

8/ Ben Hunt, Epsilon Theory, on Capital Allocators Podcast

Link to podcast. Link to podcast excerpts I found interesting.

Ben Hunt (@epsilontheory on Twitter) is a Political Science PhD who transitioned into investing. Interesting thinker. The big theme in his work is on narrative crafting, such as how a government shapes the nation’s mood to go to war, or how a stock is positioned as an up and coming one via a narrative.

What I found interesting

There are two kinds of stories / narratives in investing – one to explain why something happened, the other to upsell or sell something (related – see Kevin Kwok’s Narrative Distillation)

Two questions to ask: ‘what is your best guess’ and ‘how sure are you’. Not enough focus on the second he says quoting his mentor Gary King. Remember reading (Stanley Druckenmiller perhaps) that picking alone is not enough, and you need to size your bets too. In that regard, how sure are you matters. That determines how big and deep you can go.

Keynesian beauty contest. Interesting mental model that Ben refers to. To think of this in venture terms, where a seed investor invests in a firm over another because he thinks Series A firms will think it is attractive. Remember this came up in Abraham Thomas’ article too. It was in Ben Hunt’s podcast that I came across the concept / mental model first, and it now has a permanent place in my mental model armoury.

9/ Russell Napier interview in Swiss newspaper NZZ

Link to article. Link to my highlights.

Russell Napier is an independent macro analyst, and author. This was a very interesting interview – one that really is perspective shifting. He says we are entering an era of national capitalism, where the government will (akin to how China works) have a say in capital flows and where they are directed to. He says the monetary system is shifting to a new phase, where governments will inflate away debt. He recommends shifting away from debt and S&P500 and looking at equity that could benefit from the capex wave.

10/ Alan Taylor, Historian, on Conversations with Tyler

Link to podcast.

Thanks to the Conversations with Tyler retro, I learnt about and read the transcript for his podcast episode with historian Alan Taylor. Enjoyable one that. Alan Taylor knows his field (US Revolutionary War and 18-19th century North American history) really well, and that came through. There is a 2 page segment where he talks about how he is seeing dropping interest from students for history, primarily due to the declining prospects for employment – reduced tenure track roles, limited openings in Industry for historians in contrast with say Economics students etc.) Even as demand for academic history declines, we are seeing a huge demand for popular history, especially podcasts like ‘The Rest is History’ / Hardcore History etc. This Bloomberg piece captures the rise of the history podcast.

11/ Jake Saper, Emergence, on 20VC

Link to podcast. Link to podcast excerpts I found interesting.

I thought this Jake Saper convo w Harry Stebbings on the 20VC podcast was v good. Jake is a GP at Emergence Capital, who exclusively do B2B investing (Salesforce, Veeva, Zoom, Gusto etc) and have a crazy track record (1 out of 5 investments have become unicorns!).

2 interesting points stood out particularly

One they have an arrangement where all the partners work on a potential transaction such as doing refchecks, diligence, and not just the deal team as is with most funds.

Second, fun story about how he was made to run the gauntlet to win the right to invest in Assembled. As I have shared before, in top tier startups, the founder picks the VC s/he wants to work with, not the other way around.

12 / Victor Lazarte, Benchmark on Venture Unlocked w Samir Kaji

Link to podcast. Link to podcast excerpts I found interesting,

Short and sweet podcast featuring Benchmark’s newest Partner. Nothing terribly new on the co for venture nerds / Benchmark watchers. Two interesting passages though -

I covered this in my writing above as well) The first was on how one of the most valuable ways VCs can help founders is gaining context on the co and holding the entire company, its business model, its strategy, team dynamics, evolution etc., in their heads so founders can quickly get their reaction to a decision instead of having to explain all the context and spend time. VC as a long and preloaded context window is an interesting spin.

The second was around evaluating high growth AI companies, especially around durability of revenue. A good question to determine whether it is curiosity or real revenue is to ask if models get 10 times better, is this a better business or a worse business? Such a good question.

13/ Tyler Cowen on How I Write w David Perell

Link to podcast. Link to podcast excerpts i found interesting.

Tyler covers what kind of writing is AI-proof (writing that is more personal, memoirs, biographies where you are talking to people), how to use LLMs (provide waaay more context), and which LLMs to use for what (DeepSeek for evocative writing with higher hallucination risks, Gemini for legal etc.), the potential for AI to create books on the fly (like biographies), like how Demand Media / eHow would create pages on the fly (I think) to match google search queries.

14 / Avnish Bajaj, Z47, on the Neon podcast w Siddharth Ahluwalia

Link to podcast. Link to podcast excerpts i found interesting.

Good podcast for venture nerds, and especially those working in the Indian venture ecosystem. A glimpse into how a Tier 1 venture firm operates including the processes at work, and a peek into Avnish Bajaj’s brain. What I found interesting was the sheer number of frameworks and internal monikers that popped up - Glaring Error Bucket, 2P or 2nd pair of eyes, Pass With Conviction, Met Culture. Just like Stellaris (also covered in a Neon podcast above), Z47 too is a strong process-oriented firm with a strong focus on exhaustive coverage, i.e., making sure they don’t miss out on good / great founders.

15 / Dan Cable on Play to Potential Podcast w Deepak Jayaraman

Link to podcast. Link to podcast excerpts i found interesting.

Dan Cable is a professor of Organizational Behaviour at LBS. He has written a book called ‘Exceptional’ where he describes how we can use feedback and memories from people who have seen us in our past lives and avatar when we were exceptional or did something exceptional, to point to what actions we can undertake to become our best selves. This is a podcast in the leadership and psychology space, I enjoy listening to, but I don't often get to. If you like stuff like this, then do check out Deepak Jayaraman’s book ‘Play to Potential’ as well.

Dan Cable says

“I have learned a lot about how surprised people are when they get one of these highlights reels. And basically what that is, it is memories and stories from family, from friends, from colleagues, from mentors, it is people that have watched you over the years, even over the decades. And then they write a story that is their memory of a time you have done something exceptional, that is name of a book, that is why that book is called Exceptional, there are times when you have had an extraordinary impact and here is my memory of you doing that….that highlight reel starts to unveil ways of you becoming exceptional and I call them high leverage moves. It is just a way that you can do a little more in area and create a much bigger impact but you would not do it because you kind of downplay, you think anybody would do it. “

Bye!

It is time to wrap this! It is really really long, and perhaps the longest newsletter I have written. [One of my goals for the next few months, is to try and experiment with formats that lead to shorter and more frequent newsletters!] As I shared earlier, you should think of this substack as akin to a monthly magazine - you don’t have to read it all in one sitting, and you don’t have to read all of it!

That is all for now folks. Feedback, or your own ruminations, in the comments or at sp@sajithpai.com (Please don’t send pitches or CVs or anything work-related at my personal id; I won’t respond to them at this id; instead please use sp@blume.vc for pitches and any official comms please).

Hi Sajith,

I am halfway through reading this one. I will revisit for the remaining part of this long newsletter, Your notes are a compendium of the books, which makes it easier to grasp the concept of the books.

Being a parent, I can relate to how shifting to another location is always a challenge till our kids get settled (direction).

Delhi, compared to Bangalore, definitely scores a negative when it comes to climate/weather or pollution. But not everyone is shifting to Bangalore; Delhi/NCR still hold strong in terms of Start-ups.

Love the title of your biography, "Bandra to Bhangel".

Keep enlightening us.

Hi Sajith, was going through your book notes. Really insightful. Do you think concentration and diversification are at odds with each other as an investment strategy?