The Seed Investor as the Priest-Jester, Propulsion Partners, and Merchant Media

Sajith Pai's irregular-ish newsletter #16

Here I am with a new edition of the newsletter, in just a week since I published the last one. This is a departure from the usual languorous pace I am known for:) A big thank you to the 103 new subscribers who have joined since the last newsletter.

The newsletter has two sections. Writings - where I usually write an original piece, typically about venture or startup worlds, and, Readings - about what I read and learnt about. As some of you are aware, I am reducing my information diet away from articles / newsletters to podcasts /podcast transcripts (and of course books). So the list of readings will be heavily tilted in favour of podcast transcripts. Let us go!

Writings

(1) Captable construction and the seed investor as a priest-jester

I recently read about an edtech startup shutting down - this in itself is not surprising, given a lot more startups fail than succeed but what I found interesting was the captable. The seed was led by a Growth fund and a CVC (corporate venture capital fund) and the Series A by another growth fund (which typically does Series B upwards). The founders were all first-time founders though with high pedigree (both campus and workex).

While I do think the primary reason for the startup’s failure was very likely the waning of COVID which took away the Pandemic Market Fit (and not Product Market Fit) that it and other edtech startups had, I do think that there is a minor reason of an unbalanced captable construction as well.

Let me elaborate.

A common trend over the past few years has been the rising number of investments in seed and pre-Series A stages by growth funds. You succeed in venture by owning as much as you can of a breakout startup, and coming in earlier is one way to get a larger stake at lower prices.

Now, this might make sense when you have a second-time founder with a credible track record. It makes sense to go early here because of better signals. Now these aren't cheap any more, for second time founders are smart and know how to fund raise smartly.

What is cheap however are early stage startups led by first-time founders. And Crossover / growth funds have moved aggressively into early stage rounds of such startups as well. The amounts are tiny ($1-2m) relative to their fund size ($500m+) and playing early is a great optionality bet. If it works great, if it doesn’t it is still a small amount of money lost.

Pre-PMF startups are cheap for a reason

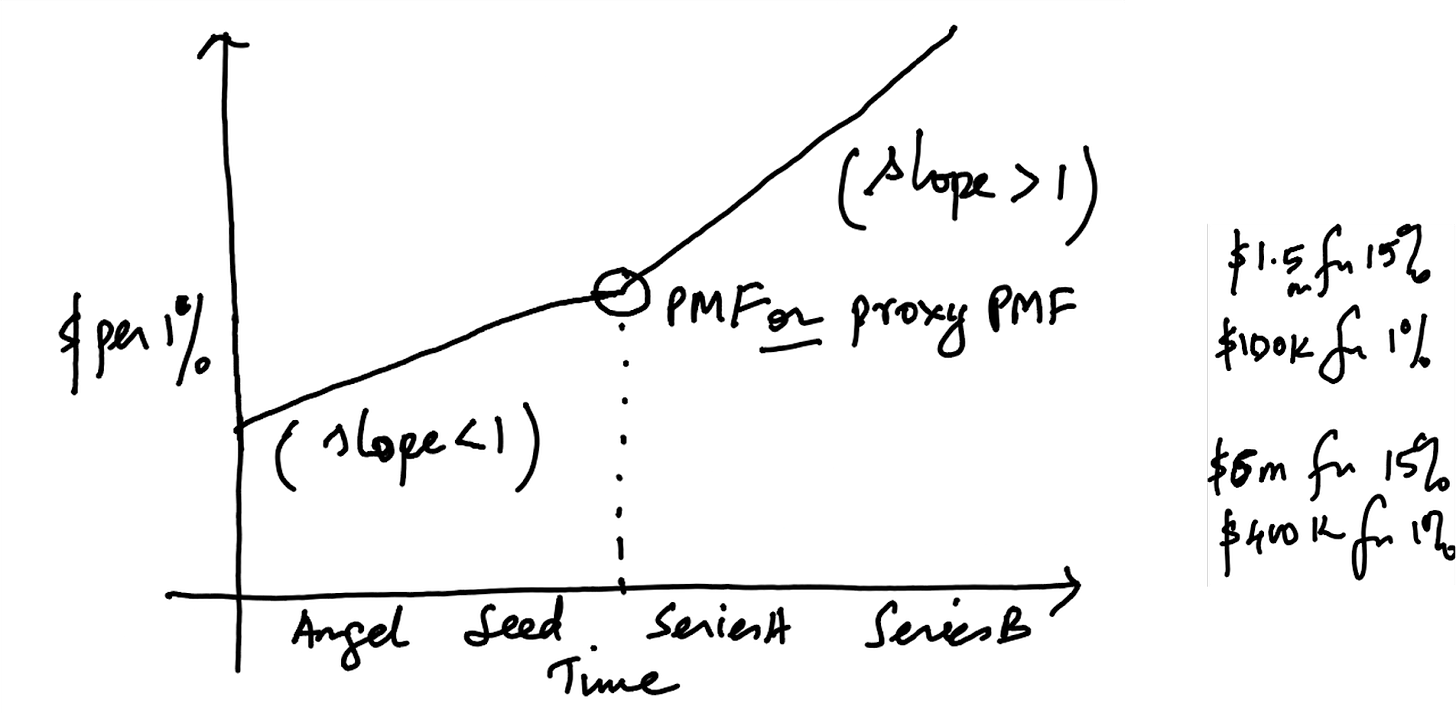

When crossover funds / growth funds go early into first-time founder-led startups, it puzzles me. For prePMF first-time founder-led startups are cheap, they are cheap for a reason.

Just under a fourth of seed-funded startups raise a Series A (Bain’s India VC Report 2019).

The single biggest reason why startups at the seed stage fail is because they don’t get to Product-Market Fit, essentially, they don’t discover a large enough market for their product.

Each stage in a startup’s life has a specific risk, and over time specialised investors have come in to operate in those stages.

Seed investors, who typically, invest in prePMF startups understand market risk, i.e., risk of not hitting PMF, well. Over time they have worked to improve their product and offerings to help startups defray the risk as far as possible. It can never be eliminated - startups are an experiment after all.

The pre-PMF startup is a learning machine, not an earning machine

The best seed investors understand that the startup at this stage is a learning machine, not an earning machine - attempting to get feedback from customers to align the product with the market they are after, and build a scalable go to market motion to take the product to the market. As much as revenue, they are also seeking predictability in revenue and coming with a repeatable, scalable playbook. The best seed investors thus do not push the startup to monetise as much as ensure that the monetisation path is one that is sustainable, repeatable and predictable.

The challenge with many growth investors is that they have typically come in post-PMF historically. Every ₹ invested in the business returns a predictably higher ₹. Headcount increase correlates linearly with revenue growth. But this is not so in early stage, prePMF stage startups. Here the scaling playbook is still not clear, the GTM motion is still not identified. The risk is that they encourage the founder to adopt the playbooks that have worked for later stage startups who have hit PMF - increasing performance marketing spends, increasing sales headcount etc.

John Danner wrote about this last year about the dangers of early Series As and the risks they posed to inexperienced investors and founders.

First-time founders would do well to ensure that they have investors on the captable familiar with the pre-PMF stage and able to support them in getting to PMF. Else they risk the startup scaling prematurely and running the risk of a blowup when revenue does not scale predictably.

The seed investor’s armoury

At the heart of the seed investor’s product (if we may call it that) or offering, is the sparring session, typically weekly or even fortnightly, with the founder. The sparring session is part therapy session, part-strategy discussion, and the objective of the session is to systematically think through the frictions coming in the way of Product Market Fit.

Mike Maples says “Product-market fit can be thought of as progressively eliminating all Herbies until there are no more Herbies. Then, you’re in a mode where you can invest in growth because it’s frictionless.”

(Herbies are essentially growth impeders; the term comes from the book The Goal by Eli Goldratt. In the book, Herbie is a large kid, whose speed delays a trek. As the weakest or slowest link in the chain, Herbie’s speed becomes the group’s speed.)

Vidit Aatrey says: “All of us think that PMF is some binary stage. Either you have it, or you don’t have it. I have realised, you always start to have some weak PMF and you have to make it stronger and stronger, right? And that’s the stage all of us go through. I’ve never seen... Something happens – obviously the step changes, but even after [the] step changes, you get to a weak PMF, and you have to keep making that flywheel better and better, so that people come and prefer you over any other platform. So, that’s how I saw it.

Both of the above quotes tell you that hitting PMF is a long process of iteration. The seed investor has evolved to help the early stage founder grapple patiently with these iterations. The sparring sessions become the mechanism for helping the founder think aloud.. The best seed investors don't propose or push any ideas overtly as much as hear the founder out - they allow the space for the founder to be vulnerable and speak about the challenges honestly; it is a safe space for the founder - and allow the founder to realise the solution themselves. Experienced seed investors have also seen similar situations before and they can pattern match well, and share this with the founder.

The worst seed investors have definitive recommendations to the founder and are inflexible in their views. They are not patient at this stage, and push the founder to make one-way door decisions that make it hard to rework the playbook later.

Beyond the sparring sessions, of course there is help on hiring, fundraising intros etc., but the core of the seed product is the thinking aloud time offered to founders.

Priest-jester

I like to think of the seed investor as akin to a combination of the priest-jester. The priest who consecrates the founder-king, and the jester who can say anything (in private though) to the founder. There is a term called Jester’s privilege, the “ability and right of a jester to talk and mock freely without being punished”. I like to think of the seed investor as having a similar privilege with a founder, often even after the founder has gone beyond the seed stage. The seed investor can ask questions, typically that no one can ask of the founder, and founder is forced to respond because the seed investor consecrated the founder and there is enough history between the founder and the seed investor.

As the startup grows beyond the seed stage, and raises Series A and growth rounds, the relationship between the two changes. The seed investor’s understanding and insights may not always stretch to the scaling stage, and the relationship changes that of business advisory or support to founder coaching.

*

(2) The lead investor and the price advantage foregone

I tweeted / Linkedin-posted a thought that has been at the back of my mind since I joined venture (about 4 years ago) on why investment leads don't get any price advantages relative to add-on or pile-on investors? This when they do all of the hard work around vetting the deal, validating the claims or data, providing conviction etc. The add-on investors benefit from the lead’s hard work and efforts, but don't compensate the lead for their efforts. Having a differential post money

Here is the tweet

The Linkedin post is here.

Now I understand the fundamental challenges around having differential pricing, and executing it (some of it is operational, some of it is procedural, though nothing impossible) but I was curious about what I was missing, and if there were any good reasons for the lead and add on investors coming in at the same price being the default.

I got a number of responses (when your follower count goes above 3k or so, twitter becomes a rather magical real time search engine) which I thought I would catalogue and share for this audience.

Broadly the responses fall in three buckets

Agreement with my tweet; with a small set being a variant: “Agree, but have you thought about?”

Disagree broadly around its impracticality / inconvenience

Disagree, and explain that the Lead’s benefits come not in any price advantage but on terms or rights.

Let us take a look at the three buckets

Agree bucket

I think the most interesting response here came on twitter from @natmalupillai - Per him, bringing add on investors helps the lead “bolster the investment decision (i.e. strongly anchor the 'conviction') by bringing-in other strong investors and that could only be possible at the same price point.”

This is a good point, stating that the lead too benefits by having more capital come, and sacrificing any (potential) price advantage for more capital is a good tradeoff.

Disagree because impractical bucket

The responses came largely from a perspective of the impracticality of the idea, and the challenge of executing it. Ayush Srivastava on twitter responded why this will be a challenge because the add-on investors are in touch with the founder (and not the lead) and they will demand the same terms as the lead investors in the same round.

Disagree because lead benefits from rights and relationships bucket

These responses say that yes, the lead does work harder, and yes, the add-ons come in at the same price, but the lead grabs the lion’s share of the investment typically (or should), and also can get investor rights that are a proxy for price benefits (prorata, board, information rights etc.) (this was best expressed by Paul Murphy of Lightspeed). Finally all of the work put in by the lead, and the conviction shown helps in the relationship premium the lead gets with the founder (Aditi Gupta of Asha Impact).

Finally, the most convenient way to price this discount or price advantage might be for the founder to give exclusive access to the lead for some secondaries at a lower price, thereby helping the lead bring down the average price per share. The founder will have to explain to the add-ons why this is being done, and provided the add-on size isn’t significant compared to the Lead’s investment size, this could work.

***

Readings

I read a lot of podcast transcripts last week. I also got a few podcasts transcribed. Listing the podcasts I read and enjoyed (in no particular order).

1 - David Fialkow, General Catalyst on 20VC.

David Fialkow reminded me very much of Sanjay Nath, co-founder and Managing Partner at Blume. Both are warm, lead from the heart personalities, for whom the relationship is what truly matters. Good podcast on the importance of EQ. TIL that David and Jim Schwartz, who cofounded Accel, are good friends, and that David sees Jim as a mentor equivalent.

Link to my public notes page with the transcript I organised.

2 - Shashank Mehta, The Whole Truth on Matrix Moments

Terrific podcast on marketing from the founder of a prominent DTC / DNVB brand. Good first principles on marketing - including every great brand rests on a powerful consumer insight, and you can stretch the brand as far as the insight allows. Lots more interesting stuff including his take on why the House of Brands model is flawed, in my scrapings / highlights of the podcast in the link below.

Link to my public notes page (with a link to the transcript).

3 - Carter Reum, M13, on Venture Unlocked

Enjoyed this podcast, especially for the ideas around Propulsion Partners, and how this has helped them create a differentiated offering.. The episode is far more relevant for those of us in the venture industry though.

Link to my public notes page with the transcript I organised.

4 - Kayvon Beykpour, exTwitter, on 20VC

Ok-ish podcast. There was nothing dramatically new here that I wouldn’t have heard before. I can see that it could be useful to aspiring PMs / product folks and those new to the startup ecosystem, but I am not sure there is much here that is ‘new’ to people with some experience.

For a better podcast on Product Management, check out Gokul Rajaram’s podcast episode on the Outliers podcast with Daniel Scrivner here.

Link to my public notes page on Kayvon Beykour’s episode with the transcript I organised.

5 - Quick Commerce in Emerging Markets with the founders of JOKR, Airlift and Zepto, on 20VC

Lots of good data in this podcast on operational metrics. What I found interesting was how important advertising is for these businesses. 2-5% of their revenue is from ads.

6 - Ruchi Sanghvi, South Park Commons on 20VC

South Park Commons is an interesting spin on the venture model. Think of it as an EIR (Entrepreneur in Residence) model institutionalised at scale. Unlike traditional venture funds which fund you, and then bring you into the portfolio community, here it starts out as a community first and then comes the funding.

Link to my public notes page with the transcript I organised.

7 - Bangaly Kaba, Popshop on 20VC

Good overview of the Growth (Hacker) role in startupland, and how founders should think about the role, as well as hire for it and manage the hire.

Link to my public notes page with the transcript I organised.

8 - Vidit Aatrey, Meesho on Sequoia’s Moonshot podcast

Meesho is a bold and distinctive co, and whatever you may say about their business now, they continue to remain a formidable force. This is thanks to a differentiated approach to org design - they are structured around problems, not functions, and have a very distinct set of values prioritizing speed, focus and independence (over collaboration). I dont know how successful they will be eventually - they are facing some headwinds as they pivot (and the last big pivot at this scale was the Zomato pivot into food delivery) - still, Vidit Aatrey deserves credit for creating an innovative firm built around an idiosyncratic approach to org design and culture. This is a good podcast to get an overview of their culture, values and approach.

Link to podcast episode (with accompanying transcript).

***

Phew, that was a lot!

That is all for now, folks. Feedback in the comments or at sp@sajithpai.com.

Also Sajith - i just read todays piece - I was able to hold thru the whole piece. More power to you. Looking forward.

Hey loved Shashank’s podcast too. Such a refreshing breath of honesty, realism and first principles based thinking. His metaphor game is so strong.