Wisdom Productivity, AI, Illiquid Careers, and the Vague Tech Canon

Sajith Pai's now infrequent newsletter #29

Welcome to the 29th edition of my rather irregular newsletter. Or, perhaps the infrequent newsletter, given that this issue, like the previous one, too comes after a four-month gap. Sigh. On to more pleasant stuff. In the interim four months, we saw 1,300+ new subscribers sign up for the newsletter. Welcome aboard, and enjoy your first newsletter. I am sorry you had to wait this long for your first fresh issue.

Quick housekeeping announcements for the new subscribers. The newsletter has two permanent sections: Writings - where I usually write and / or refer to one or more original pieces that I published in the previous months, typically about venture or the startup ecosystem, and Readings - about what I read and learnt about. My reading diet is tilted rather heavily in favour of books and podcast transcripts, and against articles / newsletters. This will naturally reflect in the reading list.

This is a long newsletter - think of it as akin to a monthly magazine from me (only the frequency may not be monthly!). I don’t know if you can read this entire newsletter (and peruse the links) in one sitting, and even if you do a second run ( which I very much doubt), you will have to pick and choose what to focus on. A good way to read this newsletter is to certainly read my original writing(s) below, and then glance through the rest and pick 1-2-3 items that pique your interest. Anything more is a bonus!

Writings

PMF Playbook / The Pick

Much of my writing energy lately has been devoted to the book on Product-Market Fit (PMF) that I am working on. I researched and wrote 7 chapters that comprise Part II of the book, that I call ‘The Pick’ over the last two months. This segment is about understanding the importance of picking the right problem to work on (or the pick) for the founder, and why getting it right matters so much for eventual PMF (product market fit). By reading it, the founder gets a good idea of how to pick the problem to work on, and validate that it is indeed the right one, through the contents of these chapters.

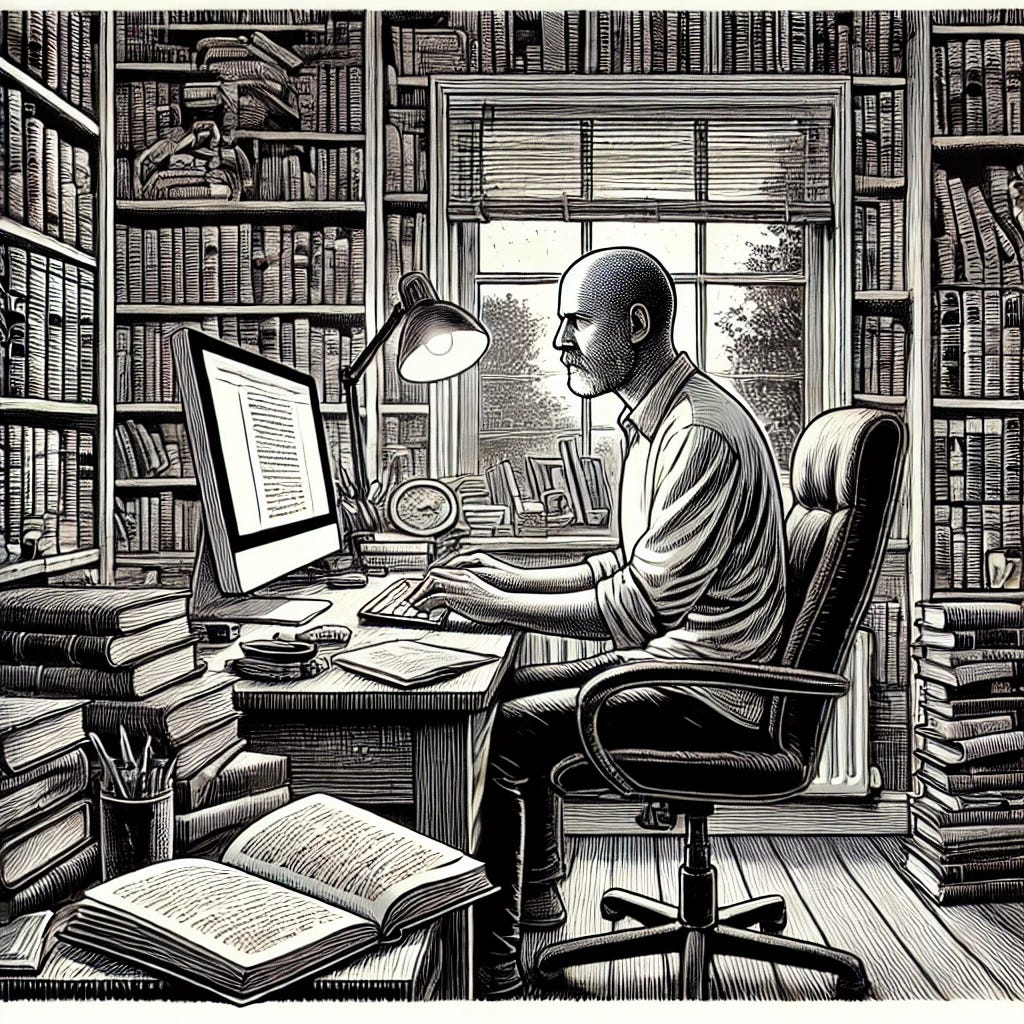

I am presently getting these chapters beta-read by volunteer readers, who responded to my callout on Twitter and LinkedIn. For enabling beta-reading and gathering feedback, I am using a software called helpthisbook.com. Screenshots from the software.

‘PMF Playbook’ is the working title, yes. The next two screenshots show the dashboard through which I access the feedback readers shared.

In the below image, you can see how I can view the specific feedback a reader left behind. This one is re a grammatical error, but you can also leave long reflections. Oh, the image below also gives you the rough table of contents:)

I got to hear of the software HelpThisBook, from a book that I read by the creator of the software. It is a book titled ‘Write Useful Books’ and it is by Rob Fitzpatrick who also authored ‘The Mom Test’, a book I read recently as well. Both are short self-published books, and highly readable and useful ones at that.

I will be publishing the seven chapters that constitute ‘The Pick’ online in early to mid-December. Subsequently over the coming year, I will write and publish the remaining chapters too. Excited to write a book around this obsession of mine, and see it come to life.

On to other pieces.

PMF Convos

I restarted the PMF Convo series. This is where I interview founders, operators, VCs who have struggled with PMF (product-market fit) successfully, or unsuccessfully, with the startups they have founded or worked with (or work at).

Episode #17 was Mohit Kumar, cofounder and CEO, Ultrahuman, a fast-growing consumer health startup, speaking to me about Ultrahuman’s PMF journey.

In addition, he shared

how his view on product-market fit (PMF) have evolved,

why more and more brands should eschew performance marketing in favour of compounding channels like content, influencer partnerships etc.,

why nudging consumers to open your app in the morning is an effective growth hack to drive retention,

as well as his advice to younger founders on building a personal runway before worrying about the company’s runway,

and finally his fave books and podcasts.

Link to the complete transcript of our convo, or a shorter set of curated highlights from the chat.

***

Episode #18 was Sri Ganesan, cofounder and CEO of Rocketlane, a SaaS startup that sells software for better customer onboarding, implementation, and professional services automation. In our convo, Sri covers the Rocketlane story giving us glimpses of the decisions that led to their success. In addition he also covers his learnings on the importance of the market and picking the space to play in well. This emerges as a key takeaway from the episode.

In our conversation, we covered

the journey of his first startup, Konotor, and how he arrived at the unlock that they were playing in the wrong end of the market, and how correcting it led to growth and momentum.

his definition of PMF as pull, and why stranger MRR is important

how they decided the problem they were going after at Rocketlane was worth it, and how they validated the solution / product

How they arrived at the community + content playbook that has decisively contributed to Rocketlane’s success.

his advice to younger founders and finally, his book recommendations.

Link to the complete transcript of our convo, or a shorter set of curated highlights from the chat.

Interview with Mel Goldman, early Indian Venture Pioneer

I published an interview of Mel Goldman, who effectively birthed the Indian venture scene in the late 1980s. As the World Bank officer in charge of the Industrial Technology Development Project, he identified four local partner institutions (who thus became venture capital firms) for loans, earmarked for the specific purpose of these institutions providing venture capital in turn to innovative Indian ‘startups’. From this initiative, the seeds of India’s now vibrant venture industry were sown.

Subsequently, Mel Goldman resigned from the World Bank, and took to a life of teaching (visiting faculty at Cornell University) and farming – operating a vineyard, and eventually launching a winery. Now in his late ‘70s, from upstate New York, he runs the award-winning Keuka Lake Vineyards. In our conversation, he reminisces about his journey to joining the World Bank, and launching the Industrial Technology Development Project. He talks about his interactions with government functionaries as well as the operators at the enterprises he partnered with. The Program, as well as the pioneers who shaped and executed it, like Mel Goldman, are forgotten today. Through this oral transcript of our conversation, I hope to bring him and the Program into the spotlight, briefly.

Interesting trivia. Mel Goldman’s father Jack Goldman is regarded as the man who founded the famous Xerox PARC labs, from where originated a lot of the technologies as well as interfaces now commonly accepted as part of computing such as the graphical user interface, ethernet / networking, laser printing etc.

Link to the (edited) transcript of our conversation: My website, or LinkedIn (same content).

Two short pieces

Smart Productivity vs Wisdom Productivity

The first was on a new strand of post-productivity pr0n literature that I see emerging - the likes of Oliver Burkeman’s ‘Four Thousand Weeks’, Celeste Hadlee’s ‘Do Nothing’ - and how I see them as occupying a space I call ‘Wisdom Productivity’ in contrast to the traditional hacks around time management, and instilling habits, which I refer to as ‘Smart Productivity’. At some point in our lives, as we begin to grapple with our mortality, we switch to wisdom productivity, I posit. The (short) essay is here.

Great Curators >> Good Creators

The second, is a take on an observation made by Luly Meservey, founder of buzzy PR firm Rostra, in a podcast (more deets in the podcast section). The take was part of a review of the podcast but is excerpted here for convenience:

One interesting point she made is on the raison d’etre for Rostra, which I see as a model of an open source co (similar to open source software monetisation model), as in the co lays out all of its trade secrets for free, and charges for help around edge cases or 1% of scenarios. She says in a world where founders have all the tools for going direct and also distribution, the value of a good PR firm is helping you read the room, as in, is the message you are going with broadly still as relevant as last week, or do you need to tinker with a little bit more, and thus give you feedback around whether your message will land well. It is also helping you mitigate the curse of knowledge. This is when you are so well-versed with a concept (your product / your tech) that you think everyone else knows it as much as you do and stop seeing it from the layperson’s eyes. This is where a good PR person can help you with feedback for you to recalibrate your message appropriately. It is sort of like a book editor, except that many book editors are also gatekeepers in addition to their editorial advisory services, so this is just the editor sans gatekeeping.

This also harks to a larger point around where the alpha in content lies, and the importance of curation and the curator. If anyone can create content thanks to GPT / AI tools, and many of these folks also have larger distribution then what is the need for media publications or media services? Primarily it will be around two areas I think

Editorial support for high stakes content: Support on creation of potentially needle-moving / high stakes content by ‘reading the room’ / providing inputs on landing the message. Because this is high stakes content, service providers can charge a lot more than usual.

Curating interestingness: Yes, a creator has massive distribution, but reader or user attention is the new chokepoint, and hence the value of a curator who is valued for their taste in curation, or commentary contextualising a topic’s importance, and thus becomes a trusted recommender or rebundler of content. Like Benedict Evans’ newsletter, or The Diff’s longreads mail etc. Analog media had inbuilt constraints built in (on creating / distribution), and digital media removed both creating and distribution constraints. But time is still finite, and there is a ton of content now suddenly hitting us, so the chokepoint has moved to what we can be attentive about, and hence the importance of attention agents who tell us where to direct our attention to, and where we can safely ignore, and why. A great curator can command as much alpha as a good creator.

Readings

Notes on podcasts, articles, and books I consumed over the past two months in this section; Readings (and not ‘Readings and Listenings’) because I usually read podcast transcripts as opposed to listening to them. I know.

After feedback from a few readers, I have now spun out the VC-related podcasts into a separate substack - venturelore.substack.com - after some of my followers complained that they didn’t find the VC-related podcasts relevant. Like here.

Hence, this newsletter will have more founder / operator focused content, while Venture Lore will have more investing / venture ops content that is specific to the venture business.

Podcasts

Here are a few of the podcast episodes I particularly enjoyed consuming.

Mike Maples Jr on the Lenny Rachitsky podcast

7 July 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

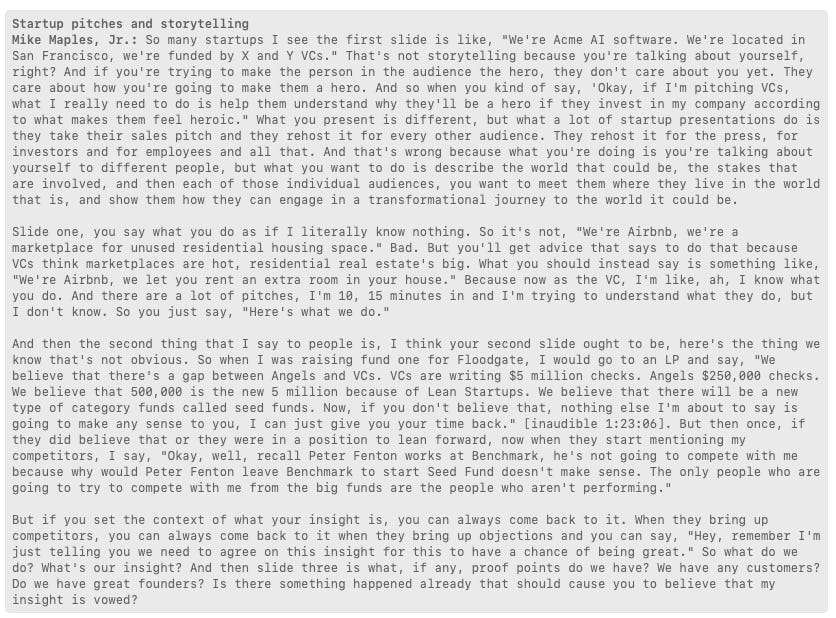

I have always enjoyed Mike Maples’s podcasts. He is a differentiated thinker, and backed by a terrific track record. These days Mike has been on a podcast tour, as he is promoting his book Pattern Breakers, which is about the success patterns or themes underlying successful startups. The title comes from his quote that “The way a startup wins is they deny the premise of the rules and propose something completely different. They radically break the pattern and cant be compared to anything which came before.” The book's basically broken up into two parts, how to come up with an idea and then the actions you need to get right to move forward an idea. In this podcast with Lenny, he covers the key themes of the book. It is worth a listen / read.

I particularly enjoyed this riff on how startups can storytell better, especially in the context of their fundraising pitch.

Emery Wells, ex Frame.io, now Adobe, on the Logan Bartlett Show

16 August 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

Sajith: Enjoyable podcast episode where Emery Wells takes us through the founding story of Frame.io - the canonical examples of a product built for himself, the challenges they went through incl three senior execs quitting on a single day, then finding success, and the sale to Adobe. A few points which stood out

‘People do what you inspect not what you expect’ so if you dont inspect the work or check in that they are aligning to the expectations you set initially then great work wont get done

Says he wants people and likes to work with people with a high pain tolerance - to do great work you need to have a high pain tolerance. The passage where he describes this seemed quiet Jobsian.

Disagrees w the Lean Startup philosophy, and says they built it up for 2.5 yrs, didnt show it to too many people and launched. But clearly he had an immense understanding of the space and says he was customer number 1. So in this context when you are building to solve a personal pain, and you have a deep understanding of the space, then perhaps you can do the caveman approach to building.

Daniel Yergin on the Dwarkesh Podcast

18 September 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

Daniel Yergin is an oil / energy expert and author of ‘The Prize’, which is an acclaimed history of oil (and as Dwarkesh says, a parallel history of the 20th century too). I haven't read the book. It is there in the bookshelf somewhere waiting to be read. For now this podcast will do. This is a riveting episode with so many interesting threads and themes. Dwarkesh’s range is incredible - from AI to Oil to Geopolitics and History (as i post this, he is doing a live lecture with military historian Sarah Paine). He is also able to see parallels between different contexts, like w Kerosene and early AI models, which is fascinating.

What stood out for me

For 50 years after oil was discovered its primary use was as Kerosene for lighting. When Edison invented the lightbulb there was a view that Rockefeller’s Standard Oil would go out of business. It was only when the motor car was invented and became popular that gasoline became the primary use of oil. (“In the 19th century gasoline was a waste product. It went for like three cents a gallon.” Interesting to see if there are parallels w AI, asks Dwarkesh. He says “Currently what we're using these models for is research and chat and whatever. That’s like the kerosene. What would the equivalent of billions of vehicles look like for AI?”

The rise of AI and compute is straining the US energy grid. A slow sclerotic industry now has been jolted awake by AI’s demands. Data centers account for 4% of US electricity and is expected to go to 10% by 2030. The US electricity industry, growing 0.35% over the past 10 years, now is seeing growth of 2% a year. Daniel Yergin says “Bill Gates said we used to talk about data centers as 20,000 CPUs. Now we talk about them as 300 megawatt data centers.”

WWII was determined by who had access to oil. Hitler’s assault on Russia was a play for Baku’s oil fields, Japan attacked Pearl Harbour when an oil embargo was levied on it. Rommel’s advances in North Africa were held back by shortage of oil. He writes to his wife, "Shortage of oil, it's enough to make one weep." Here is another from Yergin: “People have heard of kamikaze pilots who would fly their planes into aircraft carriers. One big reason they were doing that was to save fuel so they wouldn't have to fly back.”

Lulu Meservey, on Colossus’ Invest Like The Best

24 September 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

Lulu Cheng Meservey is the founder of Rostra, the ‘PR’ firm du jour, and the high priestess of the ‘go direct’ movement, where founders are encouraged to front the message about their co to the world, instead of relying on internal or external PR teams to front their point of view. I first came across Lulu on Twitter when Dwarkesh Patel thanked her for connecting him to Daniel Yergin (resulting in a wonderful podcast episode). Hmm, I said who is this? And then I read her site (rostra.co) and her message for why founders should go direct, and I was impressed. So when this episode with Patrick O’Shaughnessy was released, I knew I had to check it out.

The episode is a great introduction to Lulu’s and Rostra’s philosophy of going direct. She covers

Why founders should go direct – no transmission loss in messaging, all the tools of going direct are there, many have good distribution reach through their social followers etc.

What the key elements of going direct are – loved the line on communication being a vector and not a scalar, as in, it is important to have a communication direction or objective attached to each message

Why founders should write a manifesto whilst going direct and the contents of the manifesto

The specific publication matters less than the right journalist for sharing the message with. Individuals >> Institutions (similar to how founders sometimes select a great Partner a Tier2 fund over a so so Partner at a Tier1 fund)

How a good PR firm can help you ‘read the room’ (more on this below)

Crisis PR, and why CEOs should apologise less, and do wartime scenario exercises

3 x AI-related podcasts: Saam Motamedi, Gavin Baker, and Bret Taylor

Bunching these three podcasts together as they are themed around GenAI, AI’s impact on SaaS, AI economics and the likes. They were extremely useful in giving me mental tools and frameworks to grapple with the rise of Generative AI, its implications and emerging opportunities.

Saam Motamedi on 20VC

15 July 2024

Link to podcast.

Excerpts from the podcast that I found interesting here.

In particular, I thought his framework on how existing legacy system of record giants (Salesforce, Workday, ServiceNow) can be disrupted via shifts in the data model, delivery of value, UI, was an insightful one.

Gavin Baker on Colossus Invest Like The Best

27 August 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

This section on how the explains that GPU advances alone are not enough to understand the power of a data centre was riveting. What matters is MFU of the GPU, where MFU = model FLOPS utilization.

He then teases apart MFU into MAMMF (software efficiency) x SFU (system FLOPS efficiency). I can't say I understood it at all but it gives you a drone level view which is extremely useful.

Bret Taylor on Colossus Invest Like The Best

3 September 2024

Link to podcast + transcript.

Excerpts from the podcast that I found interesting here.

This one was particularly useful to understand the world of agentic systems. Very soon, we will be able to afford custom or generic personal agents that continually learn about us, and do all the dirty digital work (coordinating with telecallers to cancel or pause your subscriptions, or troubleshoot a bill). Similarly businesses will have functional or corporate agents. This will be the new website, and that is what Sierra is building. It is cofounded by Bret Taylor, an elite operator (ex Google, Facebook, Salesforce) who is also on the board of OpenAI.

Here is a 101 from Bret on agentic systems.

Articles

Liquid vs Illiquid careers

Link to article.

Excellent post by Vaishnav Sunil. Superb framing of careers as liquid vs illiquid. TL;DR = Liquid careers have high demand and ‘legibility’ that others can attest to your value or work, e.g., a McKinsey consultant, or an elite magic circle firm lawyer, while Illiquid careers are harder to parse for market value - a freelance marketing person who previously worked in an NGO in Africa and worked in a couple of startups before that in junior roles. Interesting, but unclear what his or her value and worth is.

Vaishnav: “When human capital is built through non-linear or less legible paths, the lack of legibility increases variance from the employer's perspective. This isn't necessarily negative, but it does increase the value of additional information. If the cost of obtaining this information doesn't justify the potential upside, candidates with less legible backgrounds may be passed over in screening processes.”

Essentially, if you are in an illiquid career, you have potentially higher alpha than in a liquid career, but it can be hard for others to parse your value / worth, without someone burning their social capital to promote you, and / or without signals or artifacts that you can provide to sell you better (say a blog, or a github repo etc).

My takeaway:

Liquidity = demand for role + legibility of the role.

You can use legibility signals (blog, github repo, someone burning social capital to intro you) to help others parse your career better. Appearance on lists like Tyler Cowen / Mercatus’s programs / fellows could be legibility signal boosters, and perhaps there could be a site which hosts such legibility signals and allows you to claim them to your profile boosts them as an alternate linkedin for illiquid careers.

As someone whose illiquid career became relatively more liquid thanks to a fortunate move to VC, the article struck a chord.

Time management techniques that actually work

Link to articles: Part 1, and Part 2.

Good collection of time management and productivity tips and hacks. The most useful might be calendaring instead of to-do lists, keeping a waiting for list, scheduling deep work time, saying no more often to meetings and instead moving them to mails, and lastly, creating a limited set of items (3 typically) that you have to get done, and doing them first as much as possible. The best of what I call Smart Productivity (in the context of my above piece on Smart Productivity vs Wisdom Productivity which I hope you read or glanced through).

Why no productivity hack will solve your overwhelm

Link to article.

I first came across IFS Or Internal Family Systems in an article on how Clay achieved PMF, where the cofounder Kareem Amin described using the technique. IFS propounds there is a family of different selves (the perfectionist vs the pragmatist vs the slacker etc) within us who are not entirely aligned with each other. It is a technique to understand ourselves better and to drive better alignment amongst our different selves. Kinda like the movie Inside Out!

In this piece, which is a response to Lenny’s pieces on productivity / time management, the author Natalie Rothfels, an executive coach, describes how some of her clients struggled to manage time better / be more productive despite knowing all of the techniques that Lenny suggested given the conflicts in their Internal Family. She gives you the broad process to overcome these conflicts. Useful read, and as I shared above, you can see Lenny’s piece in the smart productivity camp, and Natalie’s in the wisdom productivity camp.

The Silicon Valley Canon / Vague Tech Canon

Link to article.

This essay by Tanner Greer (@Scholars_Stage on twitter) contrasting the 'book writers' of Washington DC and their narrow erudition, with the 'book readers' of Silicon Valley and their broad eclectic explorations was a fun read. In particular the contrast and framing was excellent.

Bonus: The essay has a list of the Silicon Valley 'vague tech canon' (recommended by Patrick Collison et al). Lots of good reads there. That said, I H=have always felt that podcast interviews matter disproportionately in Silicon Valley / startup landscapes, as that is the lowest friction way for tech elite to broadcast their learnings / ideas.

Dwarkesh Patel’s podcast progress update

Link to article.

This 'progress update' by Dwarkesh Patel detailing how he thinks / approaches his podcast was an enjoyable read. As I shared above, Dwarkesh publishes one of the most eclectic podcast series I have seen. Perhaps only Tyler Cowen comes close. Not surprising, for both are super-learners.

This passage on how he chooses guests was illuminating. The podcast is effectively Dwarkesh’s forcing function for learning.

Chris Miller’s interview on The Generalist

Link to article / interview.

This interview by Mario Gabriele of Chip War author Chris Miller was fascinating. Perhaps Chris can write this book on petrochemichals that he is longing to read, a la Daniel Yergin's Prize (which is his fave read). I also love this concept of aimless summer reading that he does. I remember reading somewhere how Drucker would pick one topic every 2-3 yrs and read intensely on that topic - Jane Austen was one topic / author, I remember.

Michael Pettis: “The World Is not Willing to Absorb China’s Overproduction“

Link to article / interview.

Excellent summary of the challenges facing China by Michael Pettis. Essentially it overinvested in non-productive infra, and piled on debt doing so. China’s gross fixed capital formation spends as % of GDP is 43% vs India’s 29%. In doing so it piled on a fair amount of debt. A fair bit of it is worthless, and they need to get someone - private biz, central government or local govt, to accept the losses and clear the debt.

Books

I read half a dozen books over the last few months.

Ones that resonated in particular were

Rama Bijapurkar’s ‘Lilliput Land’: on the structural issues that lead to India’s undersized consumer market. Lots of interesting data here, and in typical Rama Bijapurkar fashion lots of interesting anecdata as well. I will be taking this for another round of reading over the next few months, and will be back with my take on this soon.

Rob Fitzpatrick’s ‘The Mom Test’: Easily the single best resource for conducting customer conversations better, especially during the problem validation phase of a startup (before you build the product), is the book ‘The Mom Test’ by Rob Fitzpatrick. It is a short book, and the time of 3-4 hours invested in reading it is well worth it in terms of impact. The name comes from asking questions in such a manner that even your mom can’t lie to you, because your mom will always think whatever you tell her is a great idea, and respond effusively. Hence your questions need to pass ‘the mom test’! The book encourages you to ask questions about your customers' lives - “their problems, cares, constraints, and goals” and use these “concrete facts about our customer’s lives” to “take your own visionary leap to a solution”. The book says that the later you mention your idea to the customer you are interviewing, and even better if you don’t mention your idea, the better the questions you will ask, and the more insights you will extract from the conversation. The book puts it well: “It boils down to this: you aren’t allowed to tell them what their problem is, and in return, they aren’t allowed to tell you what to build. They own the problem, you own the solution.” Link to highlights / summary.

In addition, I read two books on successful Indian corporates: Tarun Shukla’s ‘Sky High’ (on the rise of Indigo Airlines) and Anupam Gupta’s ‘The Rise of Asian Paints’, which looked at the first ~50 or so years of Asian Paints. Recently I wrapped up Gary Sernovitz’s ‘The Counting House’, an odd piece of fiction written from the lens of the Chief Investment Officer of a university endowment! I am still processing it:) Very recently, I wrapped up Alok Sama’s ‘The Money Trap’, a fun, racy, narrative of his years at Softbank, working with Masayashi Son. Presently I am halfway through Jack Farchy and Javier Blas’ ‘The World for Sale’, on the rise of commodity traders, and the power they wield. Fun so far.

Bye!

It is time to wrap this! As I shared earlier, you should think of this substack as akin to a monthly magazine - you don’t have to read it all in one sitting, and you don’t have to read all of it!

That is all for now folks. Feedback, or your own ruminations, in the comments or at sp@sajithpai.com (Please don’t send pitches or CVs or anything work-related at my personal id; I won’t respond to them at this id; instead please use sp@blume.vc for pitches and any official comms please).