Narrative Capital, How Hinduism Scales, and the PMF Pyramid

Sajith Pai's kinda irregular newsletter #17

Welcome to the latest, freshest edition of Sajith Pai’s irregular-ish newsletter. A special thank you to the 135 of you who have signed up since the last newsletter ran, and will receive their first-ever Sajith Pai newsletter:) Noice!

Quick housekeeping announcements. The newsletter has two permanent sections. Writings - where I usually write an original piece, typically about venture or the startup ecosystem, and, Readings - about what I read and learnt about. As some of you are aware, I am reducing my information diet away from articles / newsletters to podcasts / podcast transcripts (and of course books). So the list of readings will be heavily tilted in favour of podcast transcripts. This time there is a new section, the rather imaginatively-named Personal section, that has well, some personal updates.

Personal

After two-and-a-half-years or so of precaution and care, I finally got infected by COVID-19. I was diagnosed yesterday, and have been isolating since then. From what I can make out, it seems to be a mild infection (at least thus far). Barring a bad cough, and some body aches yesterday, I haven’t had any issues.

Concentrating on anything for long periods is tough. I haven’t done much reading even though a large pile of books stare at me. I did binge watch ‘Anatomy of a Scandal’. It isn’t anything that will perturb the Criterion Collection editors ever, but it was, for the mood and stage I was in, perfect mindless watching material.

I felt a bit guilty about my laziness, by noon today, that I decided to work on this issue. I started writing the original piece (this issue’s original piece is titled ‘Narrative Capital’) and it is the slowest writing I have done. It has just been hard to focus. But well, you gotta do what you gotta do.

*

In the last week of June, in what has been a blistering summer for us Delhiwallas, we did a family trip to Landour. It was my first visit to the much celebrated, quaint hill station next to Mussoorie. It is pretty no doubt, but was more crowded than I expected. The highlight of the holiday was the walk we did at Jabarkhet Nature Reserve, a private wildlife and nature park, on the Mussoorie - Dhanaulti Road.

Vipul the guide taught us to recognize the local trees - the Rhododendrons, Grey Oak (Baanj) and the famous Deodhar (‘sau saal bada, sau saal khada, sau saal pada’, a local saying about its longevity and usefulness) and also showed us this (pic below), a burnt pine (which is not native to the area - it was introduced by the Brits who wanted a fast-growing tree), next to a Rhododendron, which because it absorbs so much water, successfully survived the fire.

Writings

Narrative Capital

A fan reached out to me after a recent tweet of mine (below), asking for a ’smol essay’ on what I meant by the term ‘narrative capital’ and what it means for the future of funding. Here goes.

First, the tweet -

Narrative Capital is my term for a trend that has accelerated lately in venture capital; one where writers / podcasters / media creators purveying tech and startup content have raised funds / vehicles to invest in startups. Effectively, they are leveraging their large and growing fanbase of followers and consumers to launch an investment vehicle. These funds aren’t very large (typically in the $10-20m range) with the exception of Harry Stebbings (20VC) who did raise $140m.

What explains / underpins the rise of Narrative Capital, and what implications does it hold for venture capital’s future? Let us take these in sequence.

Understanding the rise of Narrative Capital

It is important to understand Narrative Capital’s rise as the confluence of a few trends, all relatively well-known though.

First, venture capital and tech’s success saw more and more money being allocated by large institutions (university endowments, charitable trusts, family offices etc., or the Limited Partners) to venture fund managers (General Managers). Increased supply of capital has meant both a rise in the number of funds as well as the rising size of funds, as they try to accommodate the excess capital. For the funds that are rising in size, there arises a unique first-world problem, that of deploying capital while maintaining past or better investment alpha.

Secondly, the venture investing playbook and the rules for success here is well understood and internalised across the technosphere (across founders / operators / observers and creators), such as the power law, paying up for high quality companies (than paying cheap for lower quality assets), getting access to seasoned / repeat founders etc.

The last point provides us a natural segue into an important but less known and less understood trend. This, and also our third point, is about the emergence of the repeat or second / third time founder, fluent with the ways of scaling and thus a less risky bet than a first-time founder.

And these three points thereby beg the question - if so much of the venture playbook is internalised across the technosphere, and if so much investment alpha rests on getting access to high-quality repeat / threpeat founders, then why not industrialise the access?

This is precisely what is indeed happening with the rise of such strains of early stage investing vehicles such as Founder or Operator-led Capital (e.g., Sahil Lavingia’s rolling fund), Narrative Capital, Scout Programmes etc., all of whom I bunch into a category called Access Capital (Narrative Capital is only one strain of these). These are essentially microVC funds that are effectively productising access to early stage founders.

Narrative Capitalists in particular have an unfair access advantage as a result of their distribution power. Their media properties act as bat signals attracting founders of all strains to their doors. Even if founders don’t reach out, Narrative Capitalists are likely to hear earlier about early stage investments given their networking and connects, and can also reach out to founders and get into these deals.

It makes sense thus for VCs to partner (fund) with Narrative Capitalists or for that matter the other strains of these MicroVCs / vehicles who are enabling early access to founders. Not surprisingly, a lot of the capital into these vehicles are actually coming from mainstream venture funds (and founders). Their capital needs are too small for traditional Limited Partners to consider them. Instead they are solving a deployment and access challenge for mainstream venture funds. Investing in these Access Capital enables mainstream funds to track interesting founders, and come into the successful ones without any signalling risk.

Implications for Venture Capital

Broadly this is a trend that most mainstream venture funds have welcome and spurred even.

For one, discovery of new founders has gotten harder as we have lots of new founders starting out. There isn’t as much time as before to research a space and talk to founders. Outbound, which never was a viable strategy in itself earlier, is even more underwhelming today given the jump in the number of founders. A VC fund needs a strong inbound strategy and this explains the rise of bat signals from venture funds - blogs, podcasts, newsletters by funds and VC investors.

The rise of remote dealmaking spurred by COVID means that fundraising friction has come down dramatically for founders. So the investment process is now fast (though post the meltdown it has eased up somewhat). It is very difficult for an investor to move very fast when they don’t have knowledge of the space or don’t know the founders well. This is where having one of your Access Capital partners as an investor helps as you can ref-check the space and founders through them (also very likely they would have spurred the initial intro themselves).

For founders too, the rise of Access Capital, and specifically Narrative Capital is a much welcome trend. The dealmaking is faster, there isn’t an ownership mandate per se (often Narrative Capital plays at the growth stage too for hot companies), and these fund managers are helpful too, especially in using their audience base to drive distribution. Here is an example of how a Packy McCormick story cut his portfolio co ScienceIO’s CAC by half

TLDR

Narrative Capital is one of the strains of what I like to term as Access capital, the others being Operator Capital, Scout Programmes etc. These arise because as the forces underpinning the evolution of venture capital - deployment pressure, emergence of widespread understanding of the proxies of a good founder, ability to get early access to repeat founders - make it easy for modularising venture capital into key lego blocks. The first lego block that is being carved out is Picking / Sourcing / Finding / Access (I have used these interchangeably here though within the VC community we would not use them interchangeably).

Related Readings

The Future of Solo Capitalists - Mario Gabriele

Lessons from 140+ Angel Investments - Lenny Rachitsky

Readings

I couldn’t read as many transcripts as I wanted to the last few weeks, thanks to a week off, and the weeks bookending the vacation week took on additional workloads. Still, that leaves us with five podcasts (transcripts).

(1) Farnam Street Knowledge | Kunal Shah, CRED

Link to podcast. Link to transcript excerpts.

I thought this was a really good episode. Kunal as always is interesting, provocative and insightful. He is the most interesting mind in the Indian startup ecosystem and it shows here. There is of course the old goodies such as Delta4 but there is also new stuff, for example the thinking on how education and gambling are essentially similar businesses, how gross margins and social level skipping businesses are connected etc. I thought the most interesting point in the podcast was around how Hinduism scales through birth, and not by scaling societies as Christianity, Islam do.

Farnam Street doesn’t provide free transcripts. I am a paid member, and have scraped what I thought was most interesting and shared here.

(2) Sequoia Moonshot | Prukalpa Sankar, Atlan

Link to podcast + transcript.

Prukalpa founded data collaboration platform Atlan. The podcast covers their journey from Social Cops, a data consulting play supporting Governments and Public Sector orgs, to Atlan and challenges they overcame on their way to product-market fit (PMF). I thought the most interesting part was how they decided to reduce their scope / surface edges to just AWS, Snowflake (dropping Azure for instance) to focus better even at the cost of losing clients, many of whom were in several advance conversations with them. That took courage!

(3) Prime Ventures Podcast | Ananth Narayanan, Mensa Brands

Link to podcast. Link to transcript excerpts.

Interesting podcast featuring Ananth Narayanan of Thrasio-type brands rollup play Mensa Brands talking to Shripati Acharya of Prime Ventures on D2C brands, the Mensa model and much more. I don’t agree with Ananth's views on PMF but the rest of the podcast / transcript is relevant. A few interesting points that came up -

India is woefully under-branded; there are less than 30 brands that are north of a $100 million each in fashion, beauty and home across a country the size of India with 1.35 billion people

The emergence of delivery rails + cheap data has created a new brand-building motion. This matters because India has 1st world real estate costs but 3rd world purchasing power (outside India1)

D2C brands need to crack at least two channels to grow. A key superpower is being able to hack the Amazon search rankings page. This is a huge advantage the likes of GOAT, Mensa, Globalbees can provide to their portfolio. On their own their portfolio cant hire the world's leading Amazon hacker. But a Mensa can.

(4) Invest Like The Best | Ashwath Damodaran, Professor, NYU

Link to podcast + transcript.

I am not a fan of Ashwath Damodaran when he brings his valuation lens over to early stage investing (my beef with him is detailed here) but on all other matters, I do take him very seriously.

This is a great podcast episode - covers lots of investment first principles, but of particular relevance, given it is the key topic du jour, was his dissection of inflation; how we should distinguish expected from unexpected inflation, why small cap stocks did well in the high inflation ‘70s in the US (they had more flexibility to adjust inflation; the more established you are as a company, the more your business model has already been set, the harder it is to change the way you do business!), why inflation makes it harder to undertake long-term investments (makes it hard to estimate return on capital) and how every infrastructure co in a hyper-inflationary country becomes a short-term lender. Riveting!

(5) The Product Podcast | Dan Olsen, Author: The Lean Product Playbook

Good podcast serving as a high-level summary of Dan’s book The Lean Product Playbook, and the concepts of the PMF (Product-Market Fit) Pyramid and the Lean Product Process.

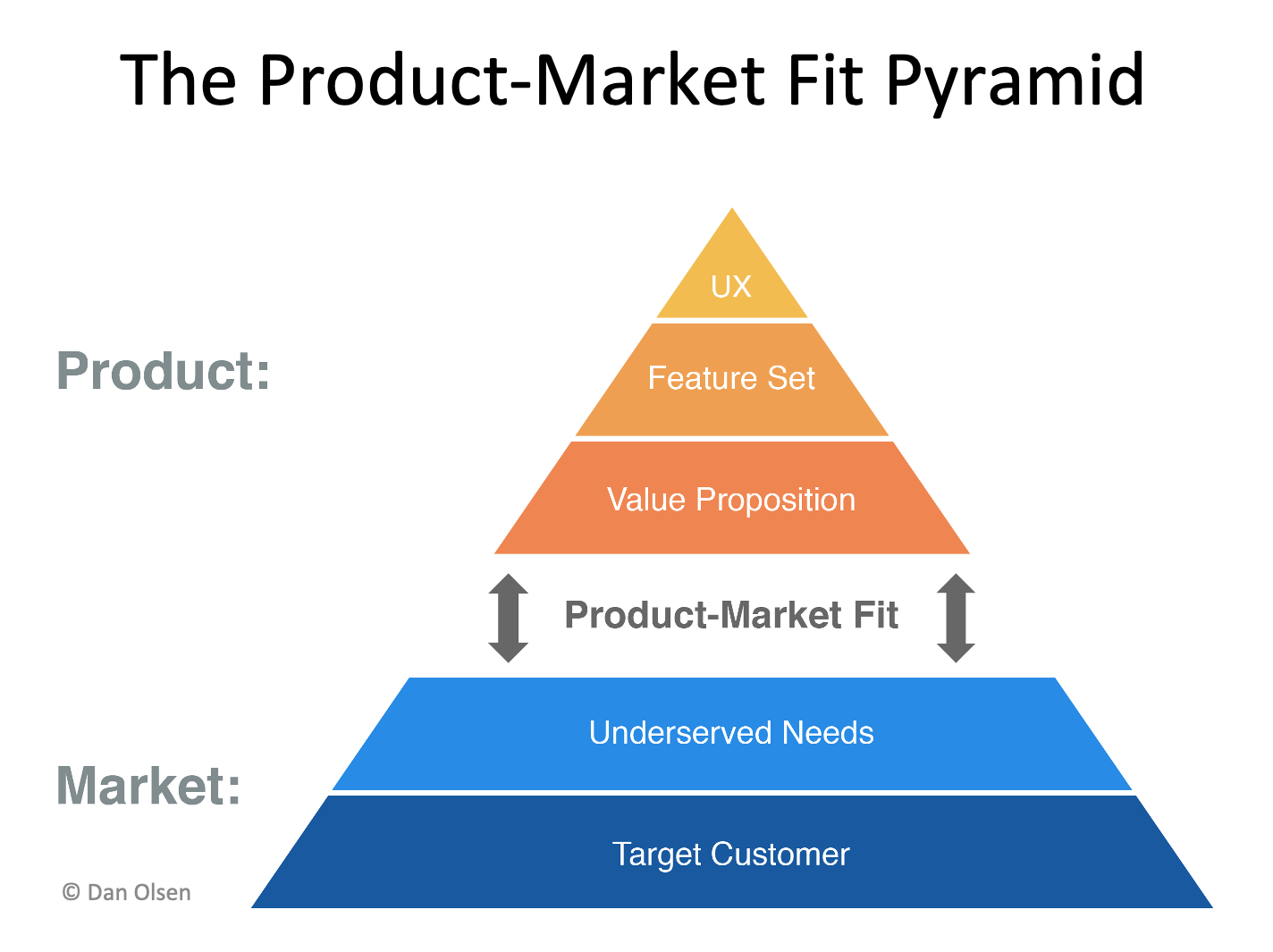

The PMF pyramid comprises the 5 key hypotheses you need to get right, in order to get to PMF. See below.

Elaborating

Target customer: who are we trying to create value for? Whose pain points are we trying to solve?

Underserved needs

Taken together these two (target customer and their underserved needs) constitute the market.

Next come the product layers.

Value Proposition: What benefits are we promising? How are we better than the competition?

Feature set or functionality (MVP comes here)

UX or User Experience: Customer uses UX to extract value proposition from the product. The UX is the encapsulation of all the decisions and hypotheses made as we worked our way through the pyramid. The next step after UX is finalised is to test the UX on / with customers.

PMF is essentially how well the decisions made in the product layer resonate with the target market you are going after. You have to get all 5 hypotheses broadly right. Lean Product Process is a framework devised by Dan Olsen, and detailed in his book The Lean Product Playbook, to work through the PMF pyramid to get to PMF. Essentially, start with market and move through the product layer.

Bye

That is all for now, folks. Feedback in the comments or at sp@sajithpai.com.

Wonderful insights Sajith, always a pleasure to be reading your blogs and posts as well. Great to note there is some intersection of the podcasts that i follow and the ones you have mentioned here :) I loved the Kunal Shah episode on TKP - delivers on maximizing the wisdom/ word ratio. I am curious though about where and why you disagree with Ananth on PMF in the Mensa model (ref: prime podcast). Looking fwd to the next edition.

Thanks Sajith for sharing the podcast list as part of the Newsletter , i did go through Kunal's talk. i loved when he spoke about how organized / structured process is must for scaling via the religion example