Follow-on rounds, blue collar workers, identifying talent and 'Four Thousand Weeks'

Sajith Pai's very irregular newsletter #15

Hello, and welcome to the rather irregular substack that I publish, about every other month or so. Thank you to the new subscribers for hitting the subscribe button, and thank you (and others) for waiting patiently for this! In this podcast, I start by taking a look at why VCs are particular about their pro ratas(!) and then cover my other writings and what I have read of late. As always, the newsletter has two sections, rather imaginatively named, called Writings, and Readings. Let us go.

Writings

Why VCs always do follow-on investments into a startup. Always.

Recently I got a cold mail (edited to remove personal identifiers)

Sajith, hope you're doing well.

By way of a quick intro - I have been investing as an angel in the Indian ecosystem for 4-5y now…been in the Banking & Fintech industry for over a decade. Most recently, was heading …. In London.

More recently, I am studying what it means to set up and run a pre-seed fund and came across your article Exhaust Fumes which was very insightful. Thank you.

Whilst studying the supporting excel in the article, I wanted to explore the possibility of "not following on" as a strategy (akin to what I am used to as an angel). Everything else being the same, the MOIC seems staggering if you choose not to follow on vs. keeping aside 50% of the capital to follow on.

I wanted to explore this further with you. Would you be open to a call / chat?

Look forward to hearing back from you. Thank you!

Regards,

XXX

*

This is an interesting question, and I thought it would be useful for more folks to read my answer, and I decided to rework my answer to him into this article. Here goes.

MOIC here stands for Multiple on Invested Capital; i.e., if you invest 1k and it becomes 25k, then the MOIC is 25x. (Do note MOIC doesnt factor in time so it is possible that there could be an investment that has a lower MOIC but a higher IRR; if the return happens in a shorter period). Why would a VC invest more money into a co when he knows that investments in later stages of a co typically yield lower multiples and can pull down your MOIC?

The question comes from an angel investor, and this is instructive. One of the fundamental differences between a VC (or any institutional investor) and an angel is that the angel typically does a one-time investment. It is extremely rare for the angel to do a follow-on investment in the next round, i.e., Angels typically come in at the preseed or seed round and never follow on or do another investment in the Series A or B rounds.

A VC however always wants to follow-on with an investment into the next one or two or more rounds. In fact the VC almost always bakes pro rata investment rights into the investment docs; pro rata rights make it possible for the VC to invest as much as is needed to maintain their stake in subsequent rounds. i.e, if a VC invests $1m for 20% in a seed round, then if the next round is say $10m, then they can invest up to $2m to maintain their stake at 20%.

Why do VCs obsess over pro rata rights so much? Why do they want to do follow in investments into a company when they know future investments will reduce the multiple?

Broadly the answer comes from the nature of venture returns. The chart below is from

Benedict Evans’s article ‘In praise of failure. It shows that 60% of all venture returns come from just 6% of investments.

This concentration of returns, where a few contribute to most of the returns, is termed the Power Law.

When the power law operates, it is best then to have maximum dollars riding on the winner. For if the bulk of the return comes from a few investments, how can you fail to maximize your exposure to these investments?

This is the fundamental reason why VCs don't want to miss a follow-on. Here is an illustration how returns differ when you don’t follow on (Angel Style) and when you do follow on (VC Style).

Scenario A (no follow on)

Under the above scenario you only invest only in 1 round in a startup. So you have $100 to invest, and you therefore invest $5 across 20 startups. Per power law, of the 20 startups say 1 does 100x, 5 startups @ 10x, 6@ 2x, 8 flame out. Thus you have $810 which is 500 (1 startup x $5 x 100x) + 250 (5 x 5 x 10) + 60 (6 x 5 x 2) + 0 (8 x 5 x 0), generated from $100.

Now let us take Scenario B (where you reinvest in winners)

Now given you have to reinvest in winners, you need to keep reserves. Typically VCs keep a 50:50 reserve (half for primary cheques which are first cheques, and half for following on). So we have only $50 for first cheques. This means we can only 10 investments. This is how Round 1 plays out.

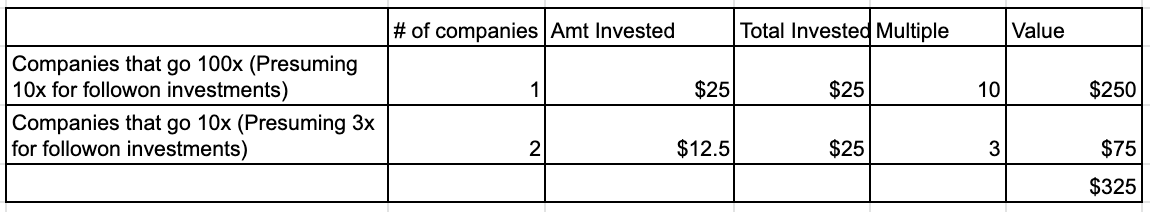

Now we have another $50 to reinvest into winners. Let us say we only reinvest in 3 startups, the ones yielding a multiple of 10 or 100. Let us say we keep $12.5 to invest in the next round, and thus we exhaust $37.5 (3 x $12.5); however in the case of the 100x co we see that there is huge investor interest and we play another $12.5. We presume that the 100x co’s follow on investments yield 10x across all its rounds (we are being conservative), and in the case of the 10x co, the follow on rounds yield 3x. So all in all we invest $25 into the 100x winner and $12.5 each into the two 10x winners. So we have

These add up to $955 ($630 + $325) which is better than the $810 that the single round only strategy yields.

Effectively by reinvesting in the winner you have converted $30 ($5 in first round, $12.5 in second round and $12.5 in third round to 750. In the case of the single round only strategy, you have only made $500 from the winner.

Supporting Google Sheet.

I remember what a mentor told me when we were chatting about the importance of reinvesting in your winners, which do pull down your MOIC. He said “Sajith - you cant eat MOIC, you can only eat absolute returns!”

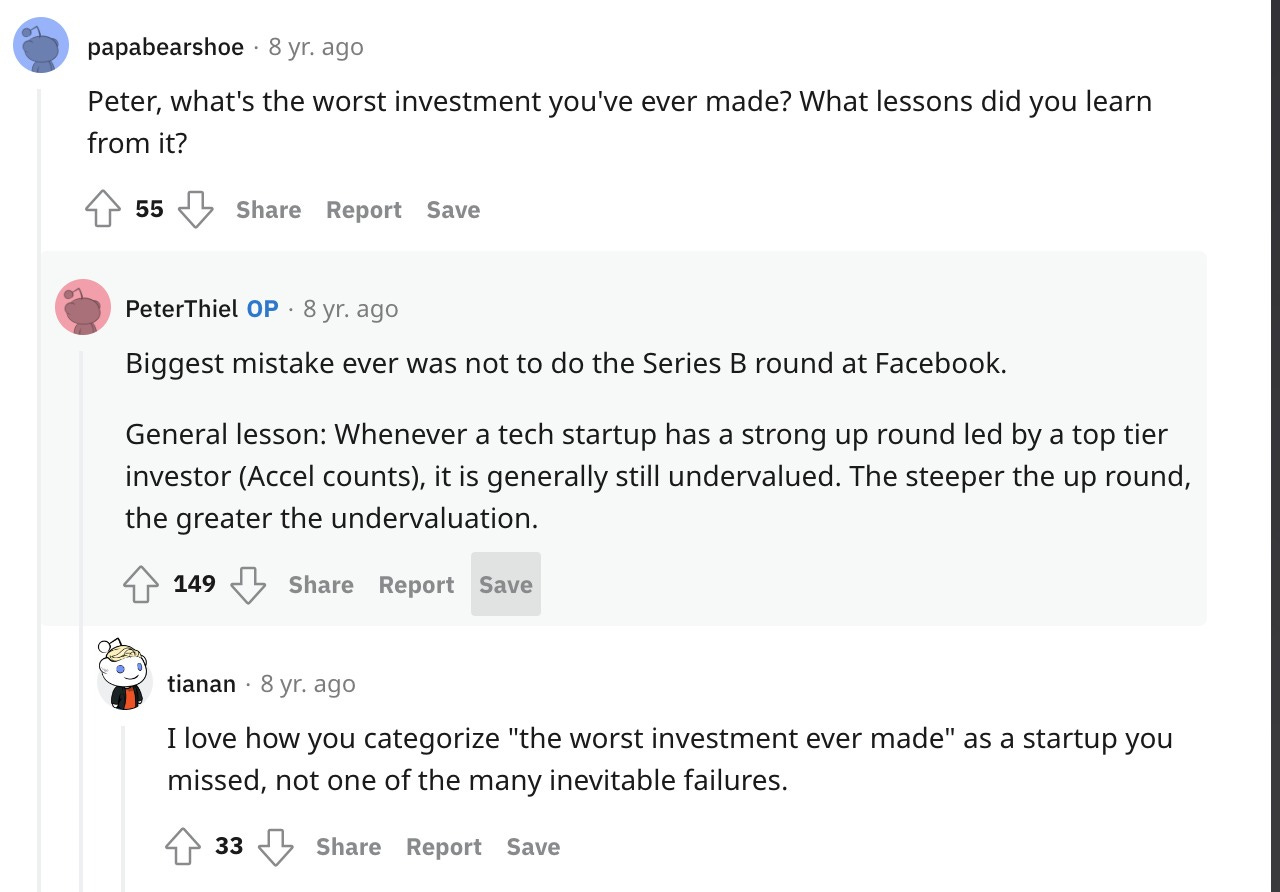

Let us close with what Peter Thiel describes as his biggest investment mistake, not following-on in Facebook!

This is from the Reddit AMA in September 2014.

(Other) writings

I wrote two pieces recently.

Smartstaff - in pursuit of a trillion $ TAM

I explain what Smartstaff, a Blume portfolio co, does. TLDR; Smartstaff helps factories source skilled labour through a staffing arrangement. To do this they leverage tech in both sourcing and staffing to help factories with their labour headaches. It is one of the most ambitious startups in our portfolio. I had a lot of fun writing this, travelling to the Southern industrial suburbs of Bangalore to meet workers and factory managers.

Newsletter & Podcast Advertising as Underpriced B2B Traction Channels

Advertising in Newsletters and Podcasts is an underrated and underpriced GTM channel, I argue, to B2B founders

Readings

Those of you who have been following me closely know that I have been reworking my reading to more podcast transcripts and less newsletters. I now track about 20 podcasts - they range from popular ones like 20VC and Colossus / Invest Like The Best to more obscure ones such as Outliers by Daniel Scrivner and Narratives by Will Jarvis. Only a couple or so of these don't have regular transcripts. In these cases I use temi.com to get a transcript and get an intern to do a read through to remove any egregious errors.

Here are some of my favourite podcast episodes from the past few weeks

1. Invest Like The Best podcast / Marco Papic

Marco Papic, a leading geopolitical analyst, working with the macro + geopolitical research house Clocktower Group, was terrific on this Invest Like the Best episode covering China’s coming stagnation (shares the three traps that China is walking into / faced with), the deglobalized multipolar world that we are in, and a riveting analysis of Russia's poor war effort. A good way to understand Papic is as if Robert Kaplan & Mauboussin had a baby.

After the episode, I picked up Papic’s book Geopolitical Alpha. I found it interesting but I didn’t think I came away with a clear lucid framework that I could use. It has about 15-20 pages dedicated to India describing why India will fail to take off the way China and South Korea did. The fulcrum constraint is underinvestment, he says.

2. 20VC / Jason Lemkin, SaaSTr

Good, no, great podcast, covering the changing venture industry, how to think about seed, how to look at SaaS sales and setting up the sales team for success. Public notes + transcript (which I got made as 20VC doesn’t publish transcripts) here.

Exceptional podcast episode where Tyler Cowen and Russ Roberts discuss each other’s reading habits as well as the books they like, and what they like about them. Public notes / highlights here.

4. 20VC / Ian Seigel, ZipRecruiter

I found Ian’s thoughts on the power of storytelling, when to stop looking at data, why he tries to stay silent as far as possible, what kind of candidates he tries to hire, extremely illuminating. It is a masterclass in how to run a company, especially from the perspective of a growth founder. Public Notes + Transcript here.

5.Tyler Cowen and Daniel Gross have a book out (called Talent) and they had two very illuminating podcasts (both with transcripts) covering the topic of how to identify talent, what interview questions are best, the topic of nature v nurture etc. Links to the podcasts - Conversations with Tyler, Invest Like The Best

*

My reading pace continued, and I wrapped up

Desperately Seeking ShahRukh by Shrayana Bhattacharya. Interesting format - segues between her personal and other (interviewee) women's interior explorations, reflected through the lens of Indian cinema especially Shak Rukh's fandom. Through the book, she covers issues that Indian women face, and how they try to overcome them or fail.

The Powerful and the Damned by Lionel Barber - FT’s Ex-Editor covers his 15-year stint at the FT, using his notes to reflect on the paper, historical events and the people he encountered. Interesting but rambling.

Four Thousand Weeks by Oliver Burkeman - I felt as if the book was written for me:) TLDR; life is short, absurdly short (the title of the book is our life span essentially). You cant do everything in this brief life. So choose, and what you choose becomes the richer and more meaningful because you have rejected many alternatives, and enjoy it. Productivity is not so much trying to do x work in y hours, and it will always spill over, but more about what should you work on.

Geopolitical Alpha by Marco Papic - We discussed this earlier. Interesting but not satisfying.

Fin

That is all for now, folks. Feedback in the comments or at sp@sajithpai.com.

Desperately Seeking ShahRukh by Shrayana Bhattacharya is a great read!