Breaking into VC, Referral-led PMF, Don Valentine, and Charlie Munger

Sajith Pai's now increasingly less irregular newsletter #25

Welcome to the 25th edition of my rather irregular newsletter! For the 140 or so new subscribers who have signed up since my last newsletter, welcome aboard. Enjoy your 1st newsletter!

Quick housekeeping announcements. The newsletter has two permanent sections: Writings - where I usually write and / or refer to one or more original pieces that I published in the previous months, typically about venture or the startup ecosystem, and Readings - about what I read and learnt about. My reading diet is tilted heavily in favour of podcast transcripts (and of course books) and against articles / newsletters. This will naturally reflect in the reading list.

This is a long newsletter - think of it as akin to a monthly magazine from me (only the frequency may not be monthly!). I don’t know if you can read this entire newsletter (and peruse the links) in one sitting, and even if you do a second run (or more which I very much doubt), you will have to pick and choose what to focus on. A good way to read this newsletter is to certainly read my original writing(s) below, and then glance through the rest and pick 1-2-3 items that pique your interest. Anything more is a bonus.

Writings

1/ A question I get all the time is how to break into VC (venture capital), or what gets you selected into a venture fund. I understand: VC is seen as a desirable job, and there is a fair amount of applicants for every role, so how does one stand out especially if not from a IIT or a BITS. So, here is my rough guide for breaking into VC. This would be useful for any level, but most for Analyst / Associate role aspirants in early stage VC.

In the post, I share my earned secrets gathered over the past five years in venture: why top-tier VC is a sellside not a buyside business, why top-tier VC is best seen as a form of enterprise sales where you sell your firm's brand of capital in turn for equity, and therefore why firms evaluate you on the basis of your ability to connect, engage and persuade rising or star founders. In addition, I share six ways to signal your abilities on this front, and stand out vis a vis other candidates. I hope you find this rough guide to breaking into venture useful!

Link to the piece.

2/ I published 2 episodes of my PMF Convo series. These are 1:1 zoom or in person conversations I have with founders, operators, VCs as part of my research on PMF (product market fit). I record and transcribe these conversations, and if the guest is willing, I release the edited transcript (no audio).

In PMF Convo #15, I spoke to Ranjeet Pratap Singh, the cofounder of Pratilipi. I have, for long, enjoyed Ranjeet’s tweets and thoughts on the challenges and learnings from building a content platform in India - one that has paved the way for a wave of vernacular language apps to inspire and follow and expand the market. In our convo, Ranjeet doesn't disappoint. He is his trademark candid, first principles self, talking about why he doesn’t like the concept of PMF (too vague), and why a better framework is to see the early startup journey as one of verifying each of the hypotheses that need to hold true for the vision to be realised, and why businesses need to address the biggest risk first.

Ranjeet then explains his perspectives on Network Effects ventures like Pratilipi - how network effects businesses see engagement metrics such as time spent increase with scale, unlike say a pure media business, the importance of liquidity (or supply of inventory) as a way to measure the health of a marketplace with network effects and finally, why frequency of usage is almost always the most important metric for consumer app companies.

Link to the transcript of my PMF Convo with Ranjeet Pratap Singh

Now to the 16th episode.

This one was with Shubham Goel of Affinity the relationship intelligence SaaS play that has hit late stage eight figures $ ARR. Shubham co-founded Affinity when he was a college student at Stanford (along with his roommate Ray Zhuo). In this convo, he talks about how Affinity hit PMF or Product-Market Fit, through a distinct referral-led motion supported by strong customer success focus, and insane product love. He then covers his definition of PMF, why he thinks founders should talk to the founders 18m ahead of them (and not any senior founder), his recommended book on selling. This was a terrific chat. Every B2B / enterprise saas founder should read the transcript. It is a systematic guide to hitting PMF. Enjoy!

Link to the transcript of my PMF Convo w Shubham Goel.

Readings

Now to Part II of the newsletter where I share what I read and found interesting.

1 - Blume’s cofounder & Managing Partner, Karthik Reddy, and his Chief of Staff, Adithya Santosh, published the Omega Files, an x-ray of our Fund I performance. It is a never-before fund performance breakdown and deconstruction, providing complete transparency of our Fund I’s investments and performance to a never seen before degree. If you are a student of venture capital, or practitioner, or aspirant, you will find it an incredibly useful resource.

Here is the chart of Fund I’s performance.

Here is a look at the educational backgrounds of our founders.

There are over 90 such fascinating charts in the Omega Files. Do give it a looksee!

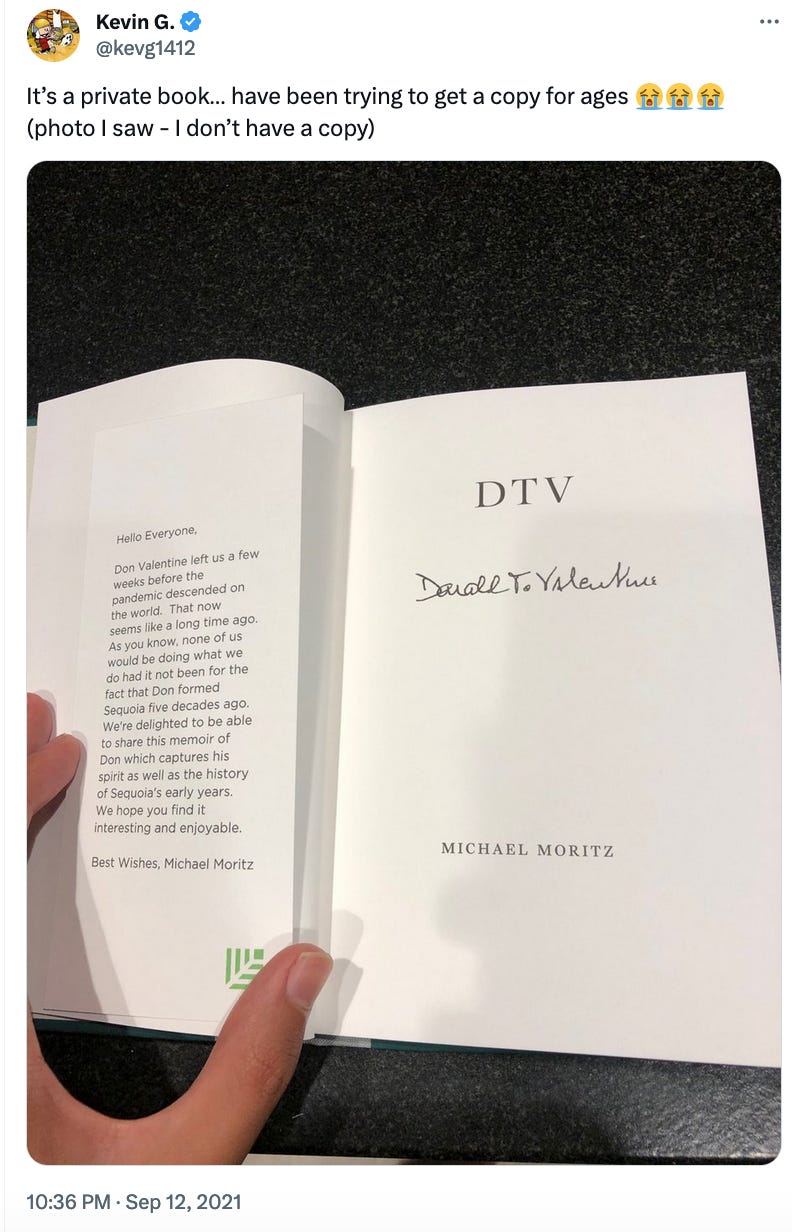

2 - In 2020 or so, Sir Michael Moritz, one of the previous Stewards of Sequoia wrote a tribute to Don Valentine, the founder of Sequoia, who had passed away the year before. It is a private book meant mostly for internal circulation, as the tweet below shares. I finally got my hands on a scan of the book. Sharing it here for fans of venture history – Click on DTV or enter bit.ly/dtvbook into your browser.

Many of you know that I have been deliberately eschewing articles in favour of podcast transcripts (given the higher signal to noise ratio in these). That trend continues.

Here are five podcasts whose transcripts I enjoyed reading, with my learning notes on them. For the first podcast in the list below, I organised the transcript, as the podcast publisher doesn’t provide the transcript. You are welcome!

A/ Jason Lemkin, Mike Maples, Eric Paley & Harry Stebbings Debate on the 20VC podcast

Good listen for seed investors this roundtable (from Sep'23) Jason Lemkin, Mike Maples, Eric Paley and Harry Stebbings debating the seed market and what seed investing is, in today's context. What stood out for me - a) often the best investments at seed are non-consensus unloved (or misunderstood) bets b) Mulligan funds ("everyone in venture gets one Mulligan fund”). Clearly, 2021 vintage fund returns are not gonna be great and LPs will have to forgive & give a 2nd chance to GPs c) Mike Maples elaboration of PMF (“product market fit answers a very important but profound question, which is what can we uniquely do that people are desperate for?”). It is a good affirmation of what good seed investing is about, and a glimpse into the craft of classic seed investing from top tier practitioners of the venture craft.

Link to podcast and transcript.

B/ Andrew Roberts, historian, on the Dwarkesh Patel podcast

Good podcast episode covering war and conflict over the ages, with a deep dive into Churchill and Napoleon (whose biographies Andrew wrote). The big takeaways for me was how the first half of 20th century saw a lot of large multi-continent conflicts, but the second half didn’t see this trend (Vietnam, Korea, Afghanistan were largely local civil wars with another large state intervening) and the reason per Andrew is nuclear deterrence (talks about how Truman’s refusal to use nukes in the Korea war kept up the taboo on nuclear weapons) and how the existence of nuclear bombs forces wars to be fought on a narrower scale than in the past. Interesting look at Churchill as an emotive, principled (vs probabilistic, logical) thinker and Napoleon as an innovative, science-friendly leader. Has a fascinating para on Andrew’s working style that allows him to write these biographies (wakes up at 4am and writes / works till 9am on his books).

Link to podcast + transcript.

C/ Andy Raskin on the Lenny Rachitsky Podcast

Really good episode, and one that founders or aspiring founders of venture-backed startups should listen to / read. Andy describes how to create a strategic narrative, a simple story to help people understand why to use / back your product. A common failing is to pitch according to the arrogant doctor framework (you have a pain, and this product solves it, so use it). A superior framework is to position this product as part of a new way of solving the problem (“The world is changing. Here is where it is going. We will help you get there.”). In the podcast Andy provides a five-step playbook to craft your strategic narrative. A key step is naming the old and the new game through an evocative moniker. This is an insightful episode, and one I personally enjoyed given it plays at the intersection of strategy and marketing / narrative crafting.

Link to podcast + transcript.

D/ Brian O’Malley of Forerunner, on Acquired w Ben Gilbert and David Rosenthal

Forerunner is one of the leading consumer VCs and Brian gives us a glimpse of what makes them special - their focus on understanding the evolving U.S. consumer comes through. They do a fair bit of primary and secondary research to glean insights to figure out key themes in the life of the consumer. One interesting theme was rising spirituality. Through the interview, he gives a glimpse of what he looks for in the founders looking to raise from him (GTM thinking, a willingness to understand and use non-performance marketing channels to reduce CAC, an understanding of margin structures and unit economics) as well as how he helps founders he backs (asking the right Qs over helping them on operational matters). Overall a good podcast for an early stage investor, especially on the consumer side.<Insert Image>

Link to podcast + transcript.

E/ Charlie Munger, Berkshire Hathaway w John Collison of Stripe on Colossus’ Invest Like The Best

Enjoyable rambling podcast covering a range of Charlie Munger’s interests including architecture, politics, why having more kids at a younger age makes you happier, and of course finance and business models. A few points stood out to me.

Munger and Buffett care deeply about money at scale in the right way, which isn’t easy but it matters to them. Munger talks about how he doesn’t want to make money the way that Sacklers did by selling oxycontin, or FDR’s family made from selling opium in China, or by owning a toll bridge affording them monopolistic pricing powers.

They have their circles of competence when it comes to investing, and want to focus on that. Predictability of earnings emerges as a key investment criterion, which is why ideally little to no tech investing which runs the risk of getting disrupted, like Kodak or Intel. That said, they did invest in Apple, where they are the largest single shareholders. They love consumer brands or utility businesses like railroads for a reason. Even with railroads, he describes how they purchased it only because the US railroad system had consolidated into two, and there was scope for even more efficiencies to be wrung (by stacking containers atop each other).

Munger is a big fan of LKY who transformed Singapore. He reveals he has two busts of people - one is Ben Franklin and the other is Lee Kuan Yew!

Link to podcast + transcript. Link to my public notes.

Bye

It is time to wrap this! As I shared earlier, you should think of this substack as akin to a monthly magazine - you don’t have to read it all in one sitting, and you don’t have to read all of it!

That is all for now folks. Feedback, or your own ruminations, in the comments or at sp@sajithpai.com (Please don’t send pitches or CVs or anything work-related at my personal id; I may / may not respond to them; instead please use sp@blume.vc for pitches please).

Good one, Sajith. All very interesting ideas. Well, I couldn't help finishing it in one sitting :) And, I'm adding those podcasts to my list, thanks for that :D