A VC reflects on the past five years, VC-Founder conflicts, and the new Jhumpa Lahiri novel

Sajith Pai's really irregular newsletter #23

Welcome to the 23rd edition of my rather irregular newsletter! For the 751 new subscribers who have signed up since my last newsletter in June, my sincere apologies to making you wait so long for your first newsletter. Nonetheless, please enjoy your first.

Quick housekeeping announcements. The newsletter has two permanent sections: Writings - where I usually write and / or refer to one or more original pieces that I published in the previous months, typically about venture or the startup ecosystem, and Readings - about what I read and learnt about. My reading diet is tilted heavily in favour of podcast transcripts (and of course books) and against articles / newsletters. This will naturally reflect in the reading list.

This is a long newsletter - think of it as akin to a monthly magazine from me (only the frequency may not be monthly!). I don’t know if you can read this entire newsletter (and peruse the links) in one sitting, and even if you do a second run (or more which I very much doubt), you will have to pick and choose what to focus on. A good way to read this newsletter is to certainly read my original writing(s) below, and then glance through the rest and pick 1-2-3 items that pique your interest. Anything more is a bonus.

(Prompt: "‘A bald, bearded man typing on a computer in Delhi in the style of Herge or a Tintin comic’; via DALL-E 3; For some reason DALL-E thinks The Taj Mahal is in Delhi)

Writings

I completed five years at Blume Ventures last month. I used the milestone to reflect on the Indian venture landscape, my observations of the craft of venture, and finally my experiences and evolution over the past five years. It is a looong piece, my longest-ever at 10k+ words. It is also a very candid piece. I hope you will read it.

Link to the piece: Reflections on Completing Five Years in Venture Capital

For those of you who find 10K words hard to digest, check this tweet thread out. Click on the image to view the tweet, or click here.

Feedback on the piece from the interwebs

Alright, let us move on then.

I had one other piece of writing the last few months (maybe I was saving it all up for the mega 10k essay). This other writing was part of a Generalist piece on a compilation of startups to watch out from India. I wrote on Classplus and how they pioneered the SaaSTra (or SaaS + Transaction) model in Indian vertical SaaS as a way to overcome the challenges of the small Indian marketsize. The piece is at ‘What to Watch in India | The Generalist’.

PMF Convos - #11, #12 and #13

PMF Convos are 1:1 zoom or in person conversations I have with founders, operators, VCs as part of my research on PMF (product market fit). I transcribe these, and if the guest is willing, I release the edited transcript. Since the last newsletter, about four months ago, I published three conversations. They are with

Abhishek Kejriwal, cofounder of community app Kutumb: Link to Convo

This was a great conversation. If you are a consumertech / consumer social app founder, then look no further. In our convo, Abhishek opens up about the early days of Kutumb, how they picked the space (running facebook ads for sourcing feedback), the growth loops that sparked off viral growth for Kutumb, his definition of PMF, pinching customers in negative direction to determine intensity of demand, the importance of flatline retention and using that to figure out brand health, the two mistakes that he sees founders make, his favourite youtube shows and more. I learnt a lot from this conversation.

Shreya Mishra, SolarSquare, previously Flyrobe: Link to Convo

This was a raw, candid chat and all credit to Shreya to talk publicly about the challenges that came in the way of PMF for Flyrobe her previous co. Despite a lot of effort at expanding the market - trying out wedding and special occasion wear, expanding into men’s categories and offline - nothing really worked. The challenge of a low TAM market ultimately dragged them down. The effort to revenue ratio was also high, which is her definition for PMF, that you can see PMF when with minimal effort you see sales take off. This candid conversation will resonate with all founders especially those who are struggling with PMF or the early phase of the startup journey.

Arindam Paul, CBO of Atomberg: Link to Convo

Arindam has emerged as one of the most insightful marketing voices from the Indian startup ecosystem over the past few years. His practical posts and threads on various aspects of marketing and growth are chock full of advice for founders and operators covering diverse topics such as brand marketing for D2C brands, advertising strategies for Amazon marketplace vs Flipkart etc. In my chat with Arindam, we cover a range of topics including how Atomberg found early PMF (product-market fit) with the B2B channel, then expanded to B2C and had to find PMF all over again, the importance of an omnichannel strategy for D2C brands, and why without such a strategy Atomberg couldn’t have scaled to where they are today (it is very hard to change customer’s channel / buying behaviour). I thought it was an extremely insightful conversation, and I hope you find it so too.

Readings

Now to Part II of the newsletter where I share what I read and found interesting. Many of you know that I have been deliberately eschewing articles in favour of podcast transcripts (given the higher signal to noise ratio in these). That trend continues. This time I talk about two books I enjoyed reading too.

Let us start with the podcasts. Here are five podcasts whose transcripts I enjoyed reading, with my learning notes on them. For the first three podcasts in the list below, I organised the transcript, as the podcast publisher doesn’t provide the transcript. You are welcome!

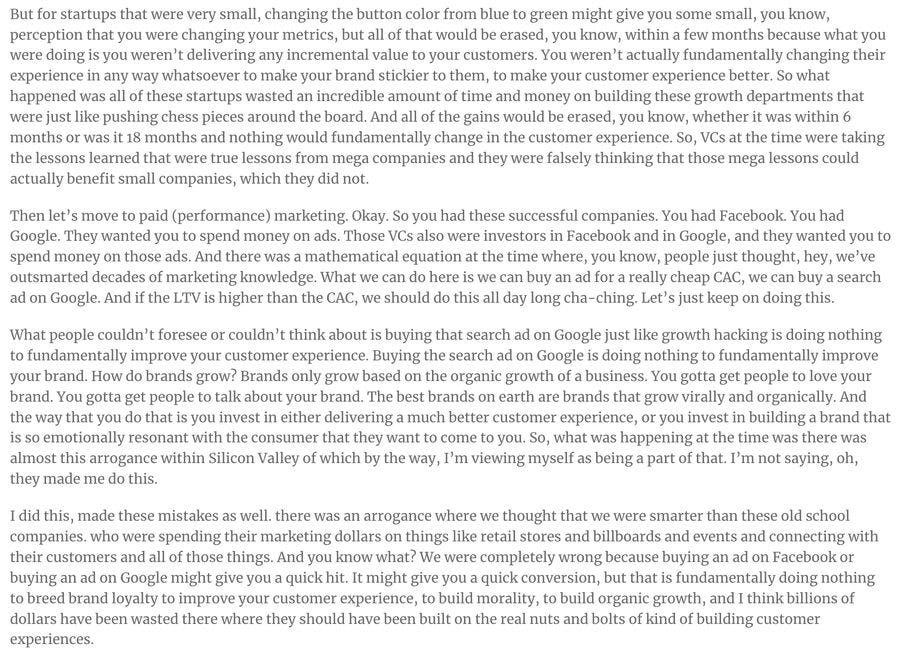

1/ Jennifer Hyman, Rent the Runway, on 20VC

Loved her observations on hiring for strengths (and not worrying about their weaknesses), how going public (and the process of doing so) helped her relook at her business in the right light and reorganise the costs, why she thinks growth hacking / paid marketing corrupted businesses and made them invest in the wrong part of the funnel etc. On the last one, she has a killer line: "Performance marketing & growth hacking ruined a whole generation of startups." Essentially she says pushing marketing $ to bottom of funnel instead of focusing on TOFU / making customer experience better, negatively impacted economics and the brand. This is a very good podcast episode for anyone in consumer brands / fashion to listen, or you can check out the highlights excerpted, in the link below!

Link to highlights (and a transcript organised by me) .

2/ Rob Go, NextView Ventures, on 20VC

Rob Go is a co-founder and Partner at NextView, investors in Attentive, Devoted Health, Whoop etc. Before co-founding NextView, Rob was a VC at Spark Capital and a PM at ebay. This is a terrific podcast giving you the inner mechanics and dynamics of raising a venture fund. It goes behind the scenes of what it is to raise a VC fund from LPs (Limited Partners, the cash providers, whose moneys the VCs invest). Some of the topics covered include what kind of documents to get ready, and what matters, your data room strategy, the single biggest driver of a VC investment, whether you should have anchor LPs, when to use Fund of Funds, LP psychology, whether concentration matters, setting expectations on timelines and sticking to it and so on. Such a lot of incredibly useful and nuanced behind the scenes info.

Link to the transcript organised by me.

3/ Sheel Mohnot, Better Tomorrow Ventures, on 20VC

Good fun chat between fintech investor Sheel Mohnot, also one of the more colourful personalities on startup twitter, and 20VC host Harry Stebbings. Sheel is forthright with his takes and perspectives covering topics such as why he thinks there is no right way in venture (many paths work per him), why the venture industry would be better off with reduced fund sizes across the board, why he believes multistage investors investing at seed stage has corrupted the seed market, why not following on is a wrong strategy, why emerging markets investing is dead, why the cardinal mistake of investing in emerging markets is overpaying, why he thinks VC value add (beyond hiring help) is bullshit, his single biggest investing mistake (not exiting more positions via secondaries) and why GP commits are a big source of misalignment between LPs and GPs. Phew!

Link to the transcript organised by me.

4/ Elizabeth Zalman and Jerry Neumann on The Logan Bartlett Show

Really candid episode where a founder Liz Zalman, and her investor Jerry Neumann discuss the challenges of being a startup founder, fundraising and venture capital from their distinct perspectives, as a founder and as a VC. Liz doesnt hold anything back, talking abt her investors who dont get into the nitty gritties with her, or dont really come prepared to board meetings, or are not able to connect with her at a personal level. There is a really interesting 15 secs where Jerry rips into Sequoia. Whoo! As a VC it gave me a really rich as well as nuanced take on the founder’s prism of the interactions they have with the VC. It also gave me a sense of the likely challenges and faultlines. I have ordered the book and can’t wait to dig into it.

Link to the highlights (also has a link to the podcast + transcript).

5/ Prof. Sarah Paine on the Lunar Society podcast w Dwarkesh Patel

Sarah Paine is a Professor of History and Strategy at the US Naval War College, as well as the author of several acclaimed books on Military History. This was an extraordinary podcast. Grateful to Dwarkesh Patel for reading Prof Sarah Paine’s books and interviewing her. Riveting exposition of military strategy or specifically grand strategy by Prof Paine, Grand Strategy is the coordination of all instruments of national power incl economic resources in pursuit of national objectives. Fascinating explanation of how in WW1, all european powers, and in WW2, Japan, let go of grand strategy. Her distinction between Maritime and Continental powers is fascinating. The canonical examples are Britain and Russia respectively. She explains the two models of colonisation basis what kind of power you are. Fascinating explanation of why China is a continental power despite a large coastline (because its threats come via land). She also details of some powerful mental models such as Death Ground (where you have no choice but to now fight to death), Half-court Tennis (where you do not factor in the opposition’s strategy into your game) etc. Really good podcast episode this. It is fun to hear these chats with scholars who are at the top of their game.

Link to highlights (also has a link to the podcast + transcript).

I haven’t been reading as many books as I would like to. Between work, and the podcast transcript readings, there hasn’t been time to fit in as many books as I would like. Still, I got to read two really good books, both translations.

The first was Papyrus, by spanish writer, Irene Vallejo. It is an eclectic, wide ranging exploration of the origin of books, and early book culture (Alexander to Romans) and a true celebration of the written word.

The second was Jhumpa Lahiri’s new short story collection, Roman Stories. I miss the Jhumpa Lahiri of the Namesake and The Lowland, two pieces of great writing (The Namesake is extraordinarily good in my opinion) that navigate exile and longing, memory and betrayal. But she has moved on, from writing in English, and exploring the theme of Indian immigrant’s exile in USA, to writing in Italian, and exploring themes of alienation and exile in Italy / Rome. Roman Stories is a collection of stories set in Rome, featuring nameless immigrants and locals, but richly wrought out, each wrestling with unrooting, alienation, the uncertainties of memory etc. Broadly similar themes to her earlier fiction but brought afresh in a new geography. Jhumpa Lahiri wrote this in Italian, and translated almost all of the works herself.

Bye

It is time to wrap this! As I shared earlier, you should think of this substack as akin to a monthly magazine - you don’t have to read it all in one sitting, and you don’t have to read all of it!

That is all for now folks. Feedback, or your own ruminations in the comments or at sp@sajithpai.com (Please don’t send pitches or CVs or anything work-related at my personal id; I may / may not respond to them; instead please use sp@blume.vc for pitches please).

Thank you for this! Might have to visit a couple of times more to assimilate :)